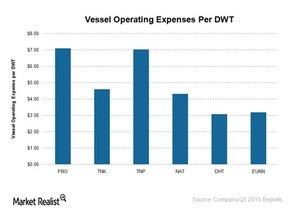

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).

July 10 2015, Published 4:42 p.m. ET

Vessel operating expenses

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO). To assess the operating leverage of a company, we look at the vessel operating expenses. We will compare the companies’ operating leverage by calculating vessel operating expense per DWT (deadweight tonnage). Leverage increases the volatility of a company’s earnings and cash flows. Leverage can also benefit the company when its revenues are rising.

The highest vessel operating expenses per DWT are incurred by Frontline (FRO) and Tsakos Energy Navigation (TNP), at $7 per DWT. The vessel operating expense for other companies like Teekay Tankers (TNK), Nordic American Tanker (NAT), DHT Holdings (DHT), and Euronav are $3.9, $4.2, $3.05, and $3.08, respectively. These expenses are primarily affected by two factors, the age of the vessel and the mix between VLCCs (very large crude carriers), Suezmax, and Aframax vessels. We already looked at the average fleet age for all companies in the previous article.

Mix of fleet

The vessel operating cost for a VLCC is higher than the cost of Suezmax and Aframax, but not in terms of vessel operating cost per DWT. Companies like Frontline (FRO), DHT Holdings (DHT), and Euronav have a higher number of VLCCs. The operating cost per DWT is lower for VLCCs as compared to other vessels due to economies of scale. A single VLCC with twice the oil capacity than smaller vessels doesn’t incur double the fuel, insurance, and crew costs.

Based on Moore Stephens’ operating cost report, the Suezmax’s operating cost per DWT has on average been 57% higher than the VLCC’s operating cost per DWT for the past three years. But at the same time, the time charter rate per DWT that a VLCC earns is lower as compared to Suezmax.

Also companies that have product tankers in their fleet have higher operating costs per DWT. Product tankers are smaller than crude tankers. Also the specific coating required for product tankers and continuous cleaning activity increases the maintenance cost for product tankers. Tsakos Energy Navigation’s (TNP) highest operating cost per DWT is attributable to a higher number of product tankers and Suezmax vessels in its fleet. Frontline’s (FRO) higher operating cost per DWT is possibly due to a higher number of older vessels in the fleet.