Chinese Sell-Off Hasn’t Affected the Global Economy

The Chinese sell-off sparked concerns about how the crash will affect economies all over the world. China makes up 11.3% of the global economy and is a huge consumer of resources.

Sept. 1 2020, Updated 9:26 a.m. ET

We haven’t seen much of an impact on the global economy so far. The Chinese sell off (FXI) could impact the U.S. (IVV) via its effect on the dollar, consumer confidence and business confidence. We haven’t seen this. Indeed, despite all the recent drama in China and Greece, the global economy and markets aren’t too far off the trajectory they were on in early 2015.

While global growth for 2015 is, once again, likely to come in below estimates, the recent volatility in China’s equity market is unlikely to exacerbate the slowdown. Growth in Europe (EZU) continues to firm. In the United States, some improvement in wage growth should help the economy pick up in the back half of the year. The longer-term slowdown in China is likely to continue, but the events of the past few months won’t have a material impact on the trajectory. The bottom line: I still expect slow, but positive global growth for the year.

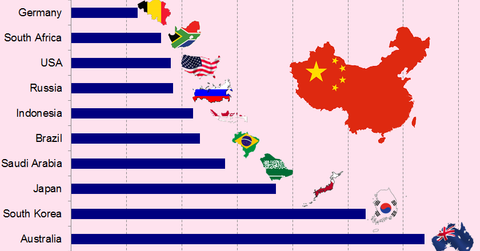

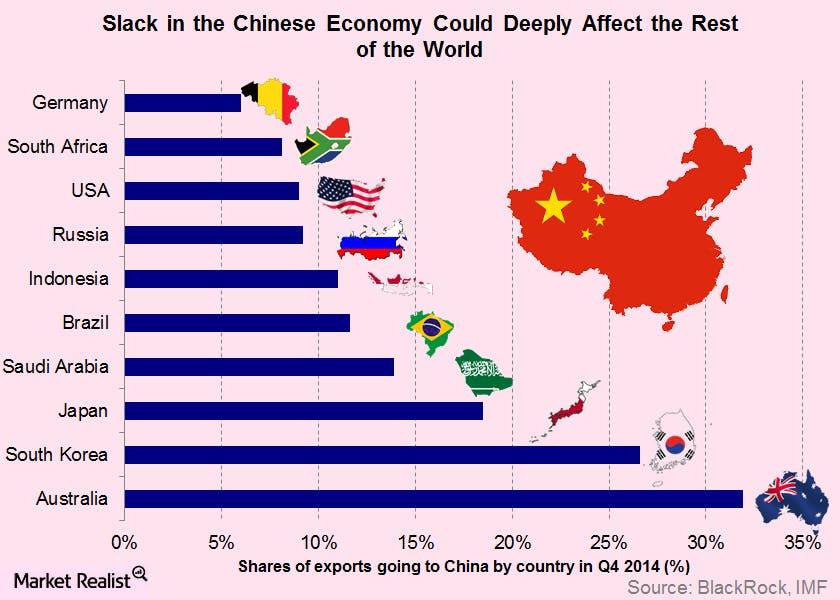

Market Realist – The Chinese sell-off sparked concerns about how the crash will affect economies all over the world. China makes up 11.3% of the global economy and is a huge consumer of resources. The above graph shows the shares of exports going to China by country in 4Q14.

Almost 32% of Australia’s exports go to China, while Japan sends 18.5% of its total exports there. More than 9% of Russian and American exports go to China. This means that a contraction in the Chinese economy could lower demand for exports, which could impact the global economy in a large way.

As we’ve seen in the previous parts of this series, stock market weakness is distinct from economic weakness. The Chinese sell-off doesn’t pose a threat to the global economy. The threat would arise in case of a rapid slowdown in Chinese economic growth.

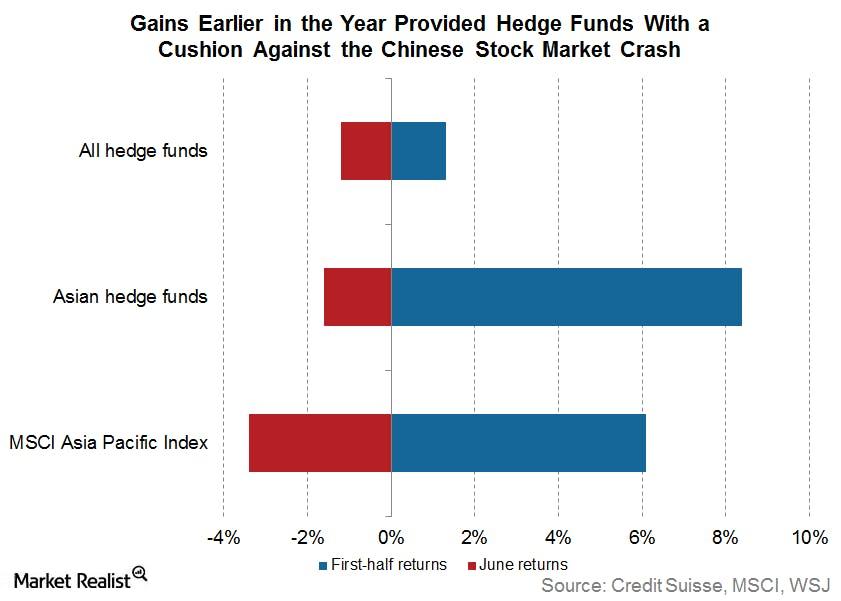

The above graph shows how early gains in 2015 helped hedge funds remain in positive territory for the year despite the Chinese sell-off and the turmoil in Greece.

The Chinese economy is likely to slow down over the next few years, and the nature of growth is likely to stay fragile in the future. Cautious investors should avoid investing in Chinese equities. Among emerging markets (EEM) (VWO), India (EPI) looks attractive on the basis of economic fundamentals, although it may look expensive on the basis of relative valuation.

Investors can look for opportunities in European markets (IEV) (VGK), which seem to have settled down in the aftermath of the deal between Greece and its creditors. Easy monetary policies and growth stimulus in Europe and Japan (EWJ) are likely to act as tailwinds for stocks in the months to come.

Commodities like gold are likely to stay volatile going ahead on account of various factors like the strengthening US dollar (UUP) and the declining demand in China.

Read our series 5 Portfolio Moves for the Second Half of 2015 to know where to look for opportunities going ahead.