Aging Population May Keep Global Growth Muted

An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing.

May 4 2021, Updated 10:40 a.m. ET

I’ve often written about the impact of technological innovation on The Blog, but there is another equally important dynamic that long-term investors need to be aware of: demographics. More specifically, the world’s aging population.

Aging population and global growth

Put simply, global growth is likely to remain lower than it has historically been because aging populations generally draw more from the economy than they contribute to it. And make no mistake: populations are rapidly aging in most developed countries (EFA). Indeed, the proportion of the developed market population older than 60 years was roughly 15 percent in 1975, but is expected to double to 30 percent by 2025, according to United Nations estimates.

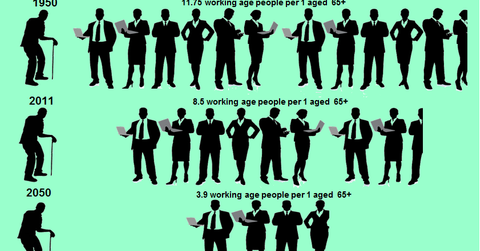

Market Realist: An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing. The scales of balance are tilting, with the old representing a greater part of the population than before. According to estimates by the United Nations, there would be only 3.9 people of working age for each person aged above 65 years in the world by 2050.

This phenomenon is picking up pace in the developed world. An older population is usually associated with lower labor productivity levels. Also, an older population tends to have a higher propensity to save, implying lower consumer spending (XLY). Moreover, entitlement spending is set on an upward trajectory as the population continues to age. These factors tend to slow the output of an economy, leading to muted economic growth.

The old age dependency ratio measures the ratio of people aged above 64 years with those representing the working age population aged 15–64 years. The above graph shows the old age dependency ratio of various developing and developed nations.

Emerging nations like Brazil (EWZ) at 11%, China (FXI) at 13%, Russia (RSX) at 18%, and India (EPI) at 8% have lower old age dependency ratios than those in the developed world. The ratio is the highest in Japan (DXJ), where it stands at a whopping 42%. The US has an old age dependency ratio of 22%.

A graying global population is likely to have many economic implications in the long term. Read on to the next part of this series to understand how this phenomenon is likely to affect monetary policies all over the world.