Targa Resources: A Midstream Energy MLP

Targa Resources Partners is a midstream energy MLP formed in 2006. The company is expanding its operations into gathering crude oil and transporting petroleum products.

June 23 2015, Published 11:12 a.m. ET

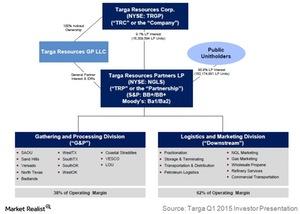

Corporate structure

Targa Resources Partners LP (NGLS) is a midstream energy MLP formed in 2006. Targa Resources Corp. (TRGP) owns the GP (general partner) interests, including incentive distribution rights in NGLS. Targa is established in midstream natural gas and NGLs (natural gas liquids). The company is expanding its operations into gathering crude oil and transporting petroleum products.

Midstream energy companies are primarily engaged in the gathering, processing, transporting, storing, and wholesale marketing of oil and gas products. They are not involved in exploration and production, also known as upstream activities. Downstream companies, on the other hand, are generally involved in refining and the distribution of gas and petroleum products to end customers.

The figure above shows Targa’s corporate structure. TRGP owns 9.1% limited partner interests in NGLS, in addition to the GP interest. We’ll look at Targa’s two divisions in more detail throughout this series.

A highly competitive industry

Midstream companies compete to acquire natural gas and oil supplies. The location of gathering and processing facilities, pricing, and access to end markets all play important roles in getting supplies. The company competes with different players in each of the segments in which it operates.

Targa’s competitors for natural gas supplies include other interstate pipeline companies such as Kinder Morgan (KMI), DCP Midstream Partners, LP (DPM), Devon Energy Corporation (DVN), Enbridge (ENB), and ONEOK Partners (OKS).

Targa also faces competition from large oil, gas, and petrochemical companies such as Enterprise Products Partners (EPD) and ONEOK for NGL supplies and marketing.

In this series, we’ll take a closer look at Targa’s business, segments, and operational performance. This will help you in making informed investment decisions about the MLP. NGLS forms ~4.5% of the Alerian MLP ETF (AMLP).