Understanding the rationale for the Covidien-Medtronic transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods.

June 25 2014, Updated 5:47 p.m. ET

Strategic rationale for the transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods. In other words, this isn’t really a situation where a company is buying out the competition. This is a complementary deal, where companies offer different products and will supposedly have better negotiating power with hospitals and can also wring out some synergies by eliminating redundant corporate functions.

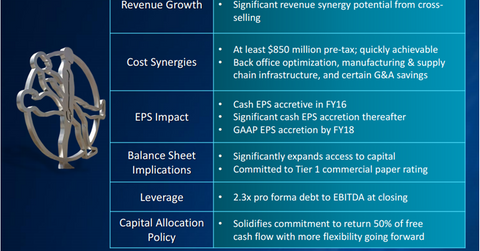

Financial rationale for the transaction

The reason that generates more focus (and controversy) is the tax inversion side of the deal. Medtronic is based in the United States, while Covidien is based in Ireland. As an Irish company, Covidien has a lower tax burden than Medtronic, specifically with respect to overseas earnings. Medtronic has over $14 billion of cash on its balance sheet. If it repatriates that money, it will have to pay U.S. taxes on it. However, if it reincorporates in Ireland, it will be able to access that money without paying U.S. taxes. The transaction itself isn’t about current tax rates—if anything, their income tax rate following the transaction will be slightly lower based on differential treatment of interest expense, but it won’t be material. The big difference will be the ability to draw upon that cash hoard in order to expand.

The companies mentioned that there could be $850 million in synergies (read: cost-cutting), which is probably not unrealistic. They’ll have similar customers and can probably rationalize some of their functions. When asked on the call about revenue synergies, the companies said it’s possible, but they didn’t want to announce them up front. Medtronic, acknowledging the political sensitivity of the situation, said the deal was mainly for strategic reasons, not tax reasons.

Other merger arbitrage information

You can find Market Realist’s primer on merger arbitrage analysis here.

Other important merger spreads include Time Warner (TWC) and Comcast (CMCSA) as well as DIRECTV (DTV) and AT&T (T).