Directv

Latest Directv News and Updates

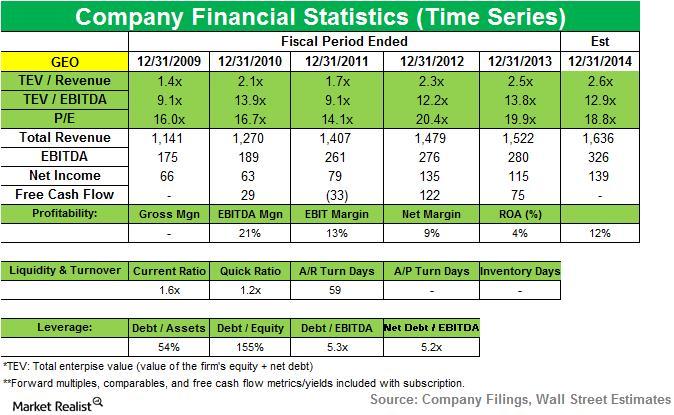

Why AQR Capital exits its position in Geo Group Inc.

AQR Capital sold a position in GEO Group Inc. in 2Q14. The company accounted for a 0.0206% position in the fund’s first quarter U.S. long portfolio.

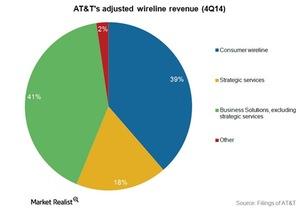

What was the key growth driver for AT&T’s wireline segment?

Adjusted revenue from IP-based strategic services grew by 14.3% YoY in 4Q14. Adjusted consumer wireline revenue increased by 2.4% during the quarter.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

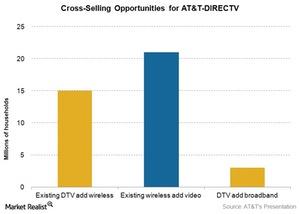

What Kind of Value Does Verizon See in Quad-Play Services?

Verizon’s (VZ) Marni Walden talked about how the company currently views quad-play offerings.

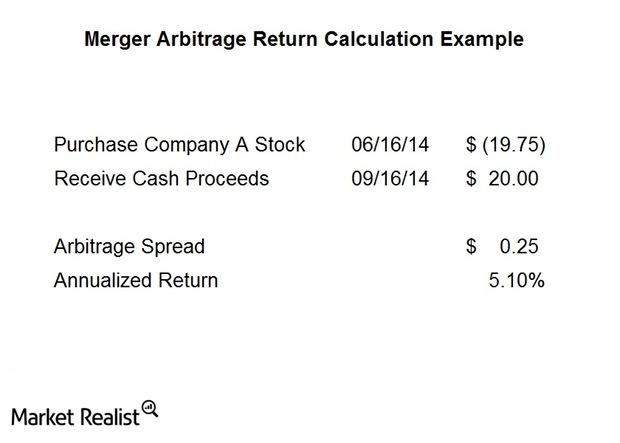

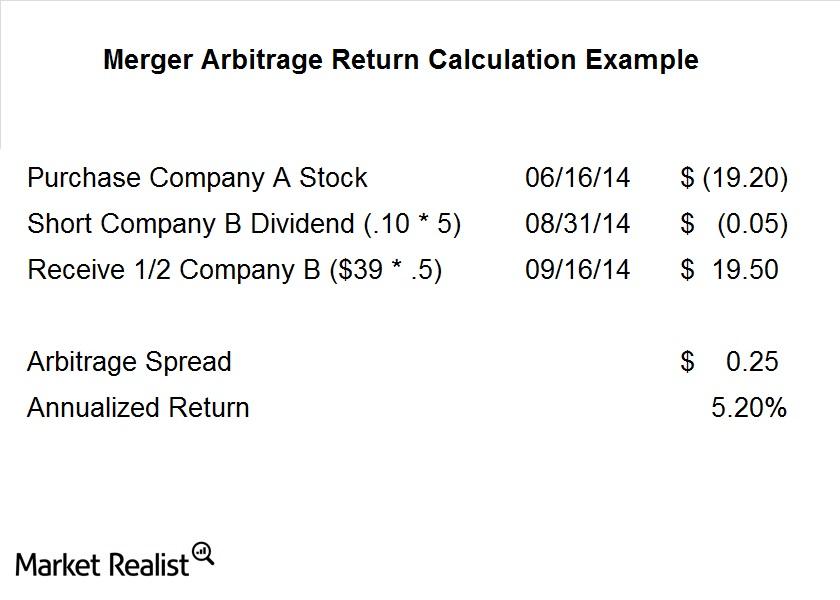

Identifying and analyzing a typical cash merger arbitrage spread

What are the components of a risk arbitrage spread? There are a number of factors that figure into a trade. Let’s look at a typical cash deal first.

Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

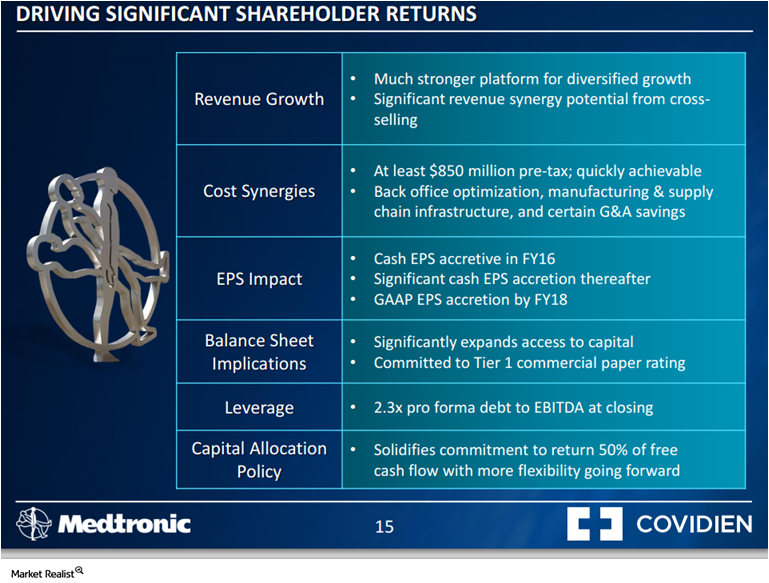

Understanding the rationale for the Covidien-Medtronic transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods.

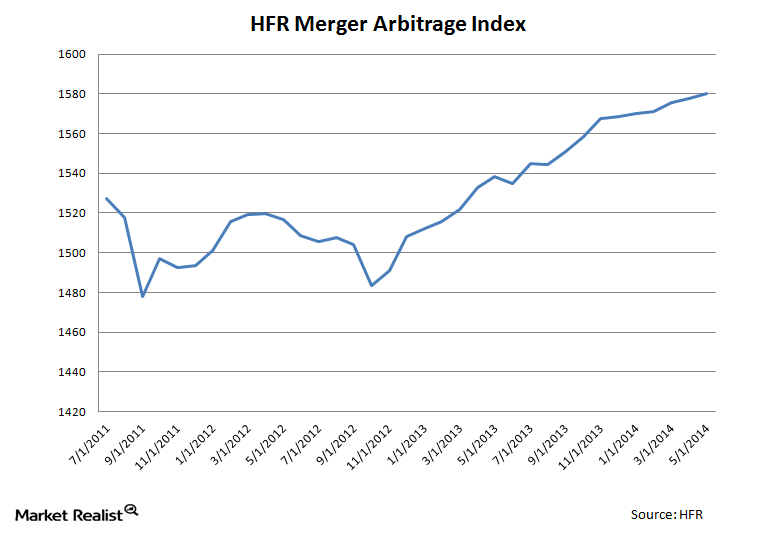

Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.