Covidien PLC

Latest Covidien PLC News and Updates

Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

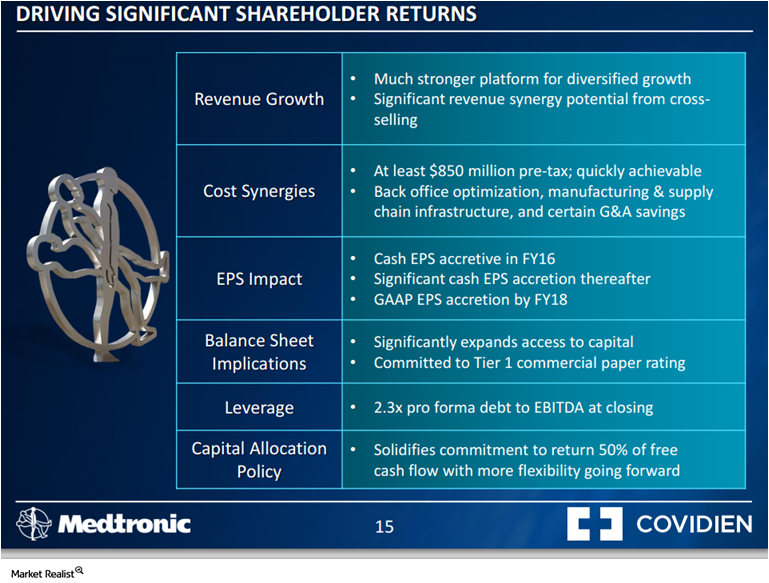

Understanding the rationale for the Covidien-Medtronic transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods.

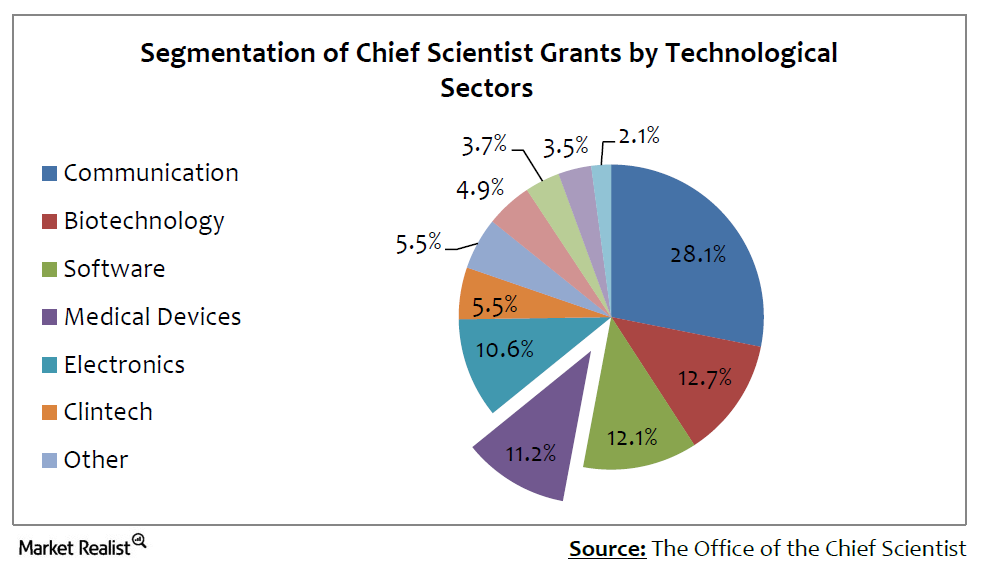

Why Israel is poised to soon lead medical device industry growth

Espicom Business Intelligence forecasts the Israeli market to be valued at $1.096 billion in 2016—a 20% increase over five years. The country looks to the medical device industry for a significant amount of growth.