Natural Gas Prices Could Overshadow the Increasing Stockpile Data

The EIA will publish the weekly natural gas in storage report on June 11. US commercial natural gas inventories rose by 132 Bcf for the week ending May 29.

Aug. 18 2020, Updated 5:31 a.m. ET

EIA report

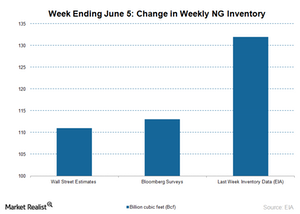

The EIA (U.S. Energy Information Administration) is scheduled to publish the weekly natural gas in storage report on Thursday, June 11, 2015. Bloomberg and Wall Street Journal surveys suggest that the gas stockpile could increase by 113 Bcf (billion cubic feet) and 111 Bcf, respectively, for the week ending June 5, 2015.

Last week, US commercial natural gas inventories rose by 132 Bcf to 2,233 Bcf for the week ending May 29, 2015. The current inventories are 50% more than the level of 1,482 Bcf in 2014. They’re also 1% more than five-year average inventory of 2,211 Bcf. The average five-year inventory gain is at 89 Bcf.

The increasing stockpile implies that demand is decreasing or supply is increasing. This is negative for natural gas prices. The inventories rose due to mild weather for the week ending June 5. In contrast, a warmer weather forecast in the next half of June 2015 could draw down inventories in the near term. The warmer weather forecast and the consensus of slowing natural gas production would support natural gas prices.

The three-day rally of natural gas prices positively impacted energy producers like Gulfport Energy (GPOR), Chevron (CVX), and Rex Energy (REXX). They account for 4.15% of the Spider Oil and Gas ETF (XOP). These companies have a natural gas production mix that’s more than 45% of their production portfolio.

Higher natural gas prices also benefit ETFs like the Energy Select Sector SPDR ETF (XLE) and XOP.