EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.

May 15 2015, Updated 9:06 a.m. ET

Overview of the segment

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities with approximately 19,300 miles of NGL pipelines, NGL and related product storage facilities, 15 NGL fractionators, and NGL import and LPG export terminal operations.

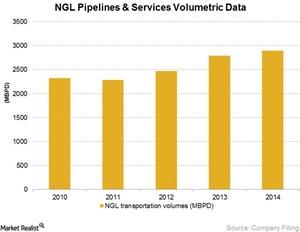

The above graph shows that NGL transportation volume grew by 4% from 2013 to 2014. Transportation volumes have been growing steadily since 2011.

Key assets of the NGL pipeline system

EPD’s principal natural gas liquids pipelines include:

- The Mid-America Pipeline System: This pipeline system has a total length of 8,065 miles and is located in the Midwest and Western US. Volumes transported on the Mid-America pipeline system primarily originate from natural gas processing plants in the Rocky Mountains and mid-continent regions. NGL fractionation and storage facilities are located in Kansas and Texas. This pipeline system includes four major assets:

- the 3,147-mile Rocky Mountain Pipeline, which transports mixed NGLs from the Rocky Mountains

- the 2,136-mile Conway North Pipeline, which links the NGL hub at Conway, Kansas, to refineries, petrochemical plants, and propane markets in the upper Midwest

- the 624-mile Ethane-Propane Mix Pipeline, which transports an ethane/propane mix primarily to petrochemical plants in Iowa and Illinois from the NGL hub at Conway

- the 2,158-mile Conway South Pipeline, which connects the Conway hub with Kansas refineries and provides bi-directional transportation of NGLs

- The South Texas NGL Pipeline System: This pipeline system has a total length of 1,918 miles and is located in Texas. This system gathers and transports mixed NGLs from natural gas processing plants in South Texas and Mont Belvieu, Texas.

- The Dixie Pipeline: This pipeline system has a total length of 1,306 miles and is located in the southeastern US. This system transports propane and other NGLs.

- The Chaparral NGL system: This pipeline system has a total length of 1,002 miles and is located in Texas and New Mexico. It transports mixed NGLs from natural gas processing plants in West Texas and New Mexico to Mont Belvieu, Texas.

Fee-based natural gas processing has been steadily growing since 2010. Midstream companies receive a fixed fee for transporting natural resources with a fee-based contract. Other types of contracts include percentage of natural resources, keep whole, percentage of proceeds, and margin sharing.

Key ETFs and stocks

Some other MLP’s that have NGL pipelines are Williams Partners (WPZ), Boardwalk Pipeline Partners (BWP), Genesis Energy (GEL), and NGL Energy Partners (NGL). These MLPs compete with Enterprise Products Partners (EPD) in the same operating segment, and they have a combined weight of 9.8% in the Alerian MLP ETF (AMLP).

In the next part of the series, we’ll discuss NGL fractionation, which is a subsegment of EPD’s NGL Pipelines & Services segment. We’ll also discuss how the NGL segment earns revenue and the impact of seasonality on its revenue.