Victor Cheng

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Victor Cheng

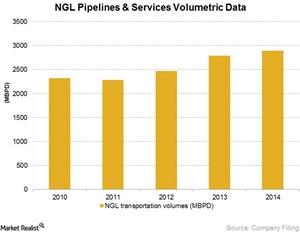

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.

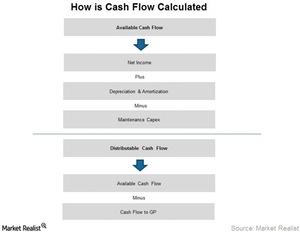

The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.

The Advantages and Disadvantages of Investing in MLPs

MLPs clearly stand out when compared to other asset classes because of their structure, yields as compared to other asset classes, and stability of cash distribution.

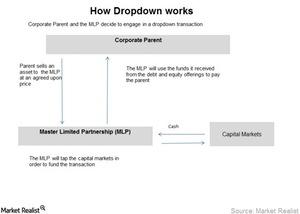

How Do Master Limited Partnerships Grow?

MLPs normally pay out all the available cash to the unit holders in the form of quarterly cash distribution. They hold only the maintenance capital expenditure.