Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson’s (JNJ) Oncology franchise grew 23.7% to ~$5.8 billion during 2016, including an operational increase of 25.2%.

March 14 2017, Updated 7:36 a.m. ET

Pharmaceuticals segment

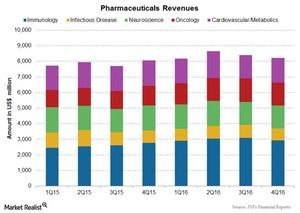

Johnson & Johnson’s (JNJ) Pharmaceuticals segment comprises several franchises—Immunology, Infectious Disease, Neuroscience, Oncology, and Cardiovascular and Metabolics. The chart below shows the quarterly revenues for the Pharmaceutical segment.

Immunology franchise

The major blockbuster drugs under the Immunology franchise are Remicade, Stelara, and Simponi/Simponi Aria. The Immunology franchise revenues reported growth of ~6.5% to ~$12.0 billion in 2016, including operational growth of 7.4%, and a 0.9% negative impact of foreign exchange.

The Immunology franchise had a strong performance in the US markets, including increased penetration for Stelara and Simponi Aria. Also, the international markets have shown positive growth across major regions. Stelara competes with Amgen’s (AMGN) and Pfizer’s (PFE) Enbrel and Abbott’s (ABT) Humira.

Infectious Disease franchise

Johnson & Johnson’s Infectious Disease franchise consists mainly of HIV products and hepatitis C products. The HIV products include Prezista and Prezcobix, while the hepatitis C virus (or HCV) products include Olysio, Sovraid, and Invico.

The revenues for the Infectious Diseases segment fell 12.3% to ~$3.1 billion in 2016, including an operational decline of 11.2% due to lower sales of hepatitis C products.

Neuroscience franchise

Johnson & Johnson’s Neuroscience franchise includes drugs such as Concerta, Invega Sustenna, and Xeplion. The Neuroscience franchise’s revenues fell 2.8% to ~$6.1 billion in 2016, including an operational decrease of 2.3%, due to the divestiture of its API business.

Invega Trinza and Xeplion were the growth drivers for long-acting injectable products. However, the US sales were affected by lower sales of Invega due to competitive products.

Oncology franchise

Johnson & Johnson’s (JNJ) Oncology franchise grew 23.7% to ~$5.8 billion during 2016, including an operational increase of 25.2%. This growth was driven by increased sales of Imbruvica and a strong uptake of Darzalex, which was partially offset by lower Zytiga sales.

The company also launched Darzalex in 15 European countries. Zytiga competes with Dendreon’s (DNDN) Provenge while Imbruvica competes with Gilead Sciences’s (GILD) Zydelig.

Cardiovascular and Metabolics franchise

JNJ’s Cardiovascular and Metabolics franchise reported a decrease in revenues of 0.3% to ~$6.4 billion in 2016, including an operational growth of 0.8% that was offset by the negative impact of foreign exchange.

The franchise’s operational growth was driven by increased sales of Xarelto. Xarelto, a blood thinner, competes with Boehringer Ingelheim’s Pradaxa, as well as Bristol-Myers Squibb’s (BMY) and Pfizer’s (PFE) Eliquis. Invokana, a diabetes drug, competes with AstraZeneca’s Farxiga.

To divest any company-specific risk, investors can consider the iShares S&P Global Healthcare ETF (IXJ) which holds 7.7% of its total assets in Johnson & Johnson.