Key Updates Investors Should Look for in Newmont’s 1Q15 Results

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

April 27 2015, Updated 5:06 p.m. ET

Newmont’s key updates in 1Q15

Investors should look out for the following key updates when Newmont Mining (NEM) releases its 1Q15 results on April 24.

Update on debt prepayment

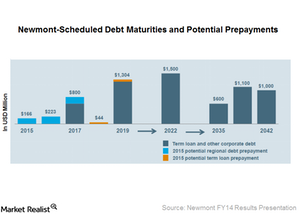

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance. In 4Q14, the company also made a $100 million payment on the term loan. The term loan doesn’t have a pre-payment penalty, and it allows Newmont to pre-pay near-term maturities first. So, it’s a good way for Newmont to deleverage the balance sheet.

Potentially, Newmont plans to repay $750 million in 2015. That would include its PTNNT (PT Newmont Nusa Tenggara) project debt as well as additional payments toward its 2019 term loan.

The company also clearly stated that even assuming lower gold prices, it has enough financial flexibility to repay more than the $166 million of the scheduled 2015 debt payments. Any progress on the company’s plan to repay $750 million in 2015 would be something to look forward to.

Barrick Gold (ABX) also plans to reduce its net debt by $3 billion in 2015, which will be its top priority. In contrast, Goldcorp (GG) has the strongest balance sheet among the senior gold producers in North America.

These three companies form 20% of the VanEck Vectors Gold Miners ETF (GDX). Investors can gain access to the gold industry through gold-backed ETFs like the SPDR Gold Trust (GLD).

Update on production profile

Newmont’s 2014 results set the stage for a strong production profile over the next three years. It is pursuing projects to improve its near-term production profile. Its three near-term growth projects are:

- Turf Vent Shaft in Nevada

- Merian in Suriname

- Waihi in New Zealand

Among the company’s new projects, a decision on the Tanami Expansion is expected by the end of 1H15. Newmont expected the Correnso project, which increases Waihi’s life by three years, to begin production in 1Q15. It will be important for investors to watch out for updates on these initiatives.

Smelter negotiations update

Newmont’s export permit in Indonesia has been renewed on the company’s assurance that it is committed to building a smelter with Freeport McMoRan (FCX). Investors will be looking forward to any updates on the ongoing negotiations.