Chilean Refined Copper Production Falls to 2-Year Low

On a year-over-year basis, Chilean refined copper production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.

April 27 2015, Updated 6:06 p.m. ET

Chilean refined copper production

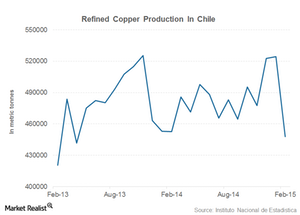

Chilean refined copper production stood at 0.45 million tons in February. This is the lowest production in Chile in almost two years. As noted in the previous part of our series, Chile (ECH) is a major copper producer and exporter. Southern Copper (SCCO) has mining operations in Chile. Indeed, SCCO has the biggest proven copper reserves.

Production down

The previous chart shows the trend in Chilean refined copper production. In the latest reading taken in February, production was down ~15% from the previous month. On a YOY (year-over-year) basis, production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.

China

February’s refined copper production in China (FXI) increased ~12% on a YOY basis. Chinese refining capacity has increased substantially over the last few years. However, copper demand has been tepid, as the Chinese economy has slowed down. China, however, still continues to add to its refining capacity. In the coming parts of our series, we’ll analyze how key Chinese economic indicators relate to the copper market.

Greater copper production in China is negative for the global copper industry. Already, the steel and aluminum industry are reeling from the impact of overproduction and higher exports from China.

Teck Resources (TCK) supplies steelmaking coal to China. Almost a quarter of TCK’s coal shipments are to China. Freeport-McMoRan (FCX) also gets a major portion of its revenues from China. These companies are directly impacted by the slowdown in the Chinese economy.

Investors in copper companies should also track the inventories at LME (London Metal Exchange) warehouses. We’ll look at this in greater detail, in our next part.