Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

March 13 2015, Published 3:51 p.m. ET

How is gold performing?

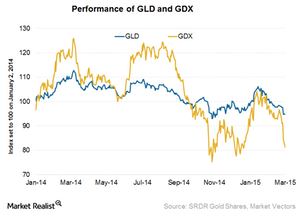

Gold started the New Year with a bang. It peaked at $1,259 per ounce on February 5, a gain of 7.4% in just over a month. But it has retreated sharply since then. On March 11, 2015, gold was trading at $1,150 per ounce. This is a whopping 5.2% fall in just over a week.

Series precap

In this series, we’ll explore the factors responsible for the recent movement in gold prices. We’ll also look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

Investors usually view gold as an inflation hedge. As a result, gold prices are influenced by the following related factors:

- macroeconomic outlook for the United States and other world economies

- performance of alternative assets such as equities, bonds, and the US dollar

- interest rates

- inflation

We’ll talk about how US data and data from other countries affect gold prices. We’ll look at the physical demand side of gold in relation to its biggest consumers, India and China. We’ll also look at the supply side of the equation. Finally, we’ll provide some perspective on where the price of gold could be headed given all these indicators.

A look at the bigger picture

Most of these indicators are published monthly. Some are reported weekly or quarterly. When examining indicators, you should be very careful to analyze them as a whole since many are interrelated.

Indicators point toward the direction of gold prices and gold-backed ETFs such as the SPDR Gold Trust (GLD). They also indicate share prices for companies such as Goldcorp (GG), Barrick Gold Corporation (ABX), Newmont Mining Corporation (NEM), and Kinross Gold Corporation (KGC) as well as ETFs such as the VanEck Vectors Gold Miners ETF (GDX). These companies combined make up 29.3% of GDX.