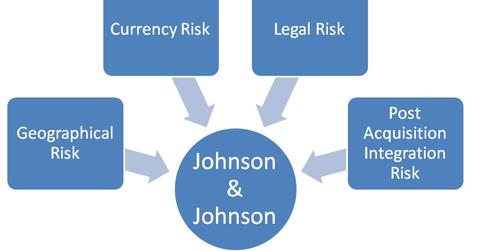

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

March 18 2015, Updated 11:05 a.m. ET

Key risks

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry. Through Enterprise Risk Management, the company identifies potential events that could affect it. It manages the associated risks and opportunities. The company provides assurance that its stated objectives will be achieved.

Geographic risk

Johnson & Johnson operates in over 60 countries. Its products are sold in over 200 countries. Also, nearly 55% of its total revenue is from sales outside the US. The widespread network reduces the geographic risk. Any changes in the social, regulatory, and economic environment in one of the markets won’t affect the business adversely.

Currency risk

Currency risk is one of the major risks that can impact Johnson & Johnson. The company receives nearly 55% its revenue from non-US markets. For 2014, the company faced nearly a 2.4% negative impact of currencies in the Consumer Products segment, a 1.6% negative impact of currencies in the Pharmaceuticals segment, and a 1.8% negative impact of currencies in the Medical Devices and Diagnostics segment.

Legal risk

Johnson & Johnson is exposed to legal risks—like patent rights and prohibition rules. For patent rights, the company is already looking for an extension for its largest selling drug—Remicade. The patents are set to expire in 2015 in some European countries. The patents are expected to retire in 2018 in the US.

For 4Q14, one of the subsidiary’s manufacturing facilities was charged for allegedly violating regulations dealing with the handling of certain wastes. It was charged by the California Department of Toxic Substances Control. The company agreed to perform certain remedial actions and pay ~$400,000 to settle the claim.

Integration risk after a merger

The company tries to minimize the integration risk after a merger by maintaining a decentralized management structure. Johnson & Johnson’s executive committee is the main management group that’s responsible for the company’s strategic operations and resource allocation. The committee oversees and coordinates the activities of the Consumer Products, Pharmaceutical, and Medical Devices and Diagnostics segments.

Johnson & Johnson, Pfizer (PFE), Merck & Co. (MRK), and Gilead Sciences (GILD) form over 30% of the total assets of the Health Care Select Sector SPDR ETF (XLV).