Why Is the Loan-to-Deposit Ratio Declining for US Banks?

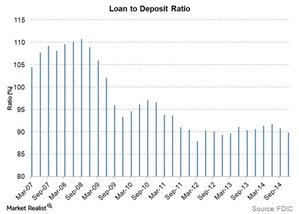

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.

April 2 2015, Updated 12:06 p.m. ET

Declining loan-to-deposit ratios

Loan-to-deposit ratio is commonly used for assessing a bank’s liquidity. It’s calculated by dividing a bank’s total loans by its total deposits. A very high ratio indicates that the bank doesn’t have enough liquidity to cover any unforeseen needs. A very low ratio might indicate that the bank is not earning as much it can on its deposits.

Factors that contribute to the decline

The industrywide loan-to-deposit ratio has declined over the last few years. The chart above shows the loan-to-deposit ratio for all US banks. One of the factors contributing to the lower ratio is the increase in non-interest-bearing bank deposits.

With rates at an all-time low, investors are putting money in non-interest-bearing deposits. Funds from non-interest-bearing deposits may be withdrawn anytime, allowing investors the flexibility to withdraw them as soon as they find better avenues of investment.

Banks may not use all of these funds to make loans, since they need to keep them available for possible withdrawals. Deposits have grown at a much faster rate than loans over the last few years.

Another contributing factor is said to be the slow demand in loans due to economic uncertainty. This has also resulted in higher reserves for most banks.

Ratio varies across banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, such as U.S. Bancorp (USB), have high loan-to-deposit ratios. U.S. Bancorp’s ratio is around 90%.

The ratio is lower for banks such as JP Morgan (JPM) due to its significant custodian banking operations that require it to hold more highly liquid assets.

A lower industrywide loan-to-deposit ratio might indicate that banks are not earning as much as they can on deposits.

The ratios for Citigroup (C), Wells Fargo (WFC), and Bank of America (BAC) lie between U.S. Bancorp’s and JP Morgan’s. Combined, C, WFC, and BAC make up ~19.5% of the Financial Select Sector SPDR ETF (XLF).