Lennar’s Diversified Land Acquisition Process

Lennar’s land acquisition process includes acquiring land from individual land owners, developers, or homebuilders. Lennar also creates JVs to acquire land.

March 25 2015, Updated 12:08 p.m. ET

How does Lennar acquire land?

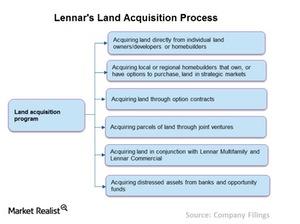

Lennar Corporation (LEN) generally acquires land for development and construction of homes for homebuyers. Land purchases are subject to specified underwriting criteria and are made through Lennar’s diversified program of property acquisition.

Lennar acquires land through multiple sources, as you can see in the chart below.

Acquiring land through joint ventures

The major emphasis of Lennar’s land acquisition process is to acquire land directly from individual land owners, developers, or homebuilders. However, the company can’t create a substantial land bank this way due to factors such as availability of suitable land at proper locations, availability of funds, and more.

As a result, Lennar (LEN) creates JVs (joint ventures) to acquire and develop land for its homebuilding operations. The land is for sale to third parties or for use in Lennar’s homebuilding operations.

Lennar (LEN) also acquires distressed assets from banks and opportunity funds, often through its Rialto segment. Land purchases at competitive rates are crucial for Lennar (LEN) and other homebuilders such as Toll Brothers (TOL) and D.R. Horton (DHI) since these purchases can increase their operating margins.

Ramping up homesites

As of November 2014, Lennar (LEN) owned 132,679 homesites compared to 125,643 in 2013. A higher number of homesites allows the company to develop and trade additional areas, which boosts its top line as well as its bottom line.

Through option contracts in 2014, Lennar (LEN) had access to an additional 31,890 homesites, of which 24,855 were through option contracts with third parties and 7,035 were through option contracts with unconsolidated entities in which the company has investments.

ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones U.S. Home Construction Index Fund (ITB) takes exposure in the stock based on the financial health of the company as perceived by the funds.