What investors should know about Regions Financial Corporation

Regions Financial Corporation is a leading regional bank in the southeastern US. It’s the 17th largest bank in the US—based on assets.

March 9 2015, Published 12:06 p.m. ET

Overview

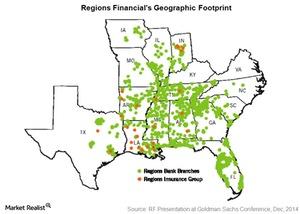

Regions Financial Corporation (RF) is a leading regional bank in the southeastern US. It has $120 billion in assets. It’s the 17th largest bank in the US—based on assets. It’s a full-service provider of consumer and commercial banking, wealth management, and mortgage and insurance products and services. Regions Financial operates in 16 states across the South, Midwest, and Texas.

The map above shows the states where Regions Financial operates.

History

Regions Financial was formed in 1971 as First Alabama Bancshares Inc. It was formed with the combination of three banks:

- First National Bank of Huntsville – formed in 1856

- First National Bank of Montgomery – formed in 1871

- Exchange Security Bank of Birmingham – formed in 1928

It got its present name, Regions Financial Corporation, in May 1994. It merged with Union Planters Corp. in 2004 and AmSouth Bancorporation in 2006.

Main activities

Regions Financial’s primary source of income is the interest income earned on loans. Net interest income forms ~64% of the company’s total income. Other sources of income include service charges on deposit accounts, card and ATM fees, investment management and trust fees, mortgage income, and other income. The above graph shows the breakup of the company’s income by type.

Competition

Regions Financial competes with national banks as well as other regional banks in different businesses. Its competitors in the region include BB&T (BBT) and SunTrust Banks (STI). They have operations in the southern US. It faces competition from big banks operating throughout the US including JPMorgan Chase (JPM), Wells Fargo (WFC), and Bank of America (BAC). Regions Financial forms ~0.44% of the Financial Select Sector SPDR ETF (XLF).

How are Regions Financial’s key matrices—including ROE (return on equity), earnings, and dividends—performing? Why does it focus on business lending? How does its stock compare to its peers? In this series, we’ll answer all of these questions. We’ll discuss Regions Financial’s operating segments, its funding costs, interest margins, and asset quality.