An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

March 30 2015, Published 12:51 p.m. ET

Copper supply chain

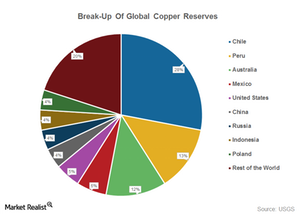

Previously, we discussed China’s place as the world’s largest copper consumer. In this part, we will discuss copper’s supply side dynamics. Copper reserves are highly concentrated, unlike other basic metals like iron ore and bauxite, which are dispersed.

The above chart shows the breakup of global copper reserves. As you can see, Latin America accounts for almost half of the world’s copper reserves. Chile has the highest reserves of copper, followed by Peru. Southern Copper (SCCO) has mining operations in both countries, holding the largest proven copper reserves.

Australia has the third largest reserves of copper. Mining giants like Rio Tinto (RIO) and BHP Billiton (BHP) have operations in Australia. BHP’s various listings form 18.9% of the iShares MSCI Global Metals & Mining ETF (PICK).

Production

Extracted copper has a very low copper content, and it must be further treated to make it usable. For example, Indonesia implements restrictions against the export of unprocessed ores. Freeport-McMoRan (FCX) and Newmont Mining (NEM) have operations in Indonesia. Freeport currently forms 3.25% of the SPDR S&P Metals and Mining ETF (XME).

China has the world’s biggest copper smelting and refining capacity. Investors should closely track the trends in China’s copper industry. In the next article, we will discuss the key indicators of the Chinese economy.

Copper prices

Copper prices are another key indicator that Freeport investors should track. Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health. In the next part, we will discuss the latest trends in copper prices.