Generics Are Climbing up the Value Chain

Severe cost pressure can lead to the commoditization of generics. it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

March 23 2015, Updated 1:05 p.m. ET

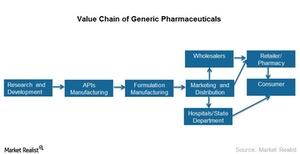

Generic drug industry’s value chain

Currently, the generic drug industry is operating under severe cost pressure due to intense competition. This leads to the commoditization of generics. To reduce this, it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

Please refer to the above chart for the generic drug industry’s value chain. Now, we’ll discuss the elements of the value chain.

Research and development

Traditionally R&D (research and development) has been low in the industry. However, in recent years, leading generic companies bolstered R&D to develop complex and differentiated products. This is done either through acquisitions or building their own capabilities. For example, Mylan (MYL) acquired Agila in 2013 to enhance its capabilities in injectables. Actavis (ACT) acquired Forest to boost its specialty R&D capabilities.

Manufacturing

Manufacturing can be broken into two categories:

- Manufacturing of APIs (active pharmaceutical ingredients)

- Formulation—finished dosage form

Formulations are manufactured by combining APIs with other ingredients and processing them into dosage forms—like tablets, syrups, and injectables.

The time to market is important in the generics business. The first mover has advantages like market exclusivity. Therefore, early access to high quality and difficult to manufacture APIs is critical. To address this, a few big companies have become backward vertically integrated. For example, Mylan acquired a 71% stake in India’s Matrix Laboratories in 2006.

Also, there are companies—like Teva (TEVA) and Periggo (PRGO)—that develop, manufacture, and market generic drugs, or formulations, as well as APIs.

Marketing and distribution

This step includes the transportation and handling of generics from the manufacturer to the consumer. The consumer could be wholesalers, hospitals, retailers, physicians, or specialists. Outsourcing, franchise, and partnerships are trends in the industry. Recent consolidation in the wholesale industry increased buyers’ bargaining power significantly. This is expected to be negative for the generic industry’s pricing and margins.

There are companies—like Actavis Plc (ACT) and Mylan—that have distribution companies in addition to the distribution of products through wholesalers. This will help the companies reduce the impact on their margins.

Pharmaceutical ETFs—like the iShares U.S. Healthcare ETF (IYH) and the VanEck Vectors Pharmaceutical ETF (PPH)—are capitalizing on the industry’s profitability.