Nicole Sario

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Nicole Sario

Central Nervous System Is Key to Teva’s Specialty Medicines

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

How Actavis Has Emerged through Mergers and Acquisitions

In October 2012, Actavis completed the acquisition of Actavis Group. In 2013, the company’s revenues outside the US increased to 29% from 16% in 2012.

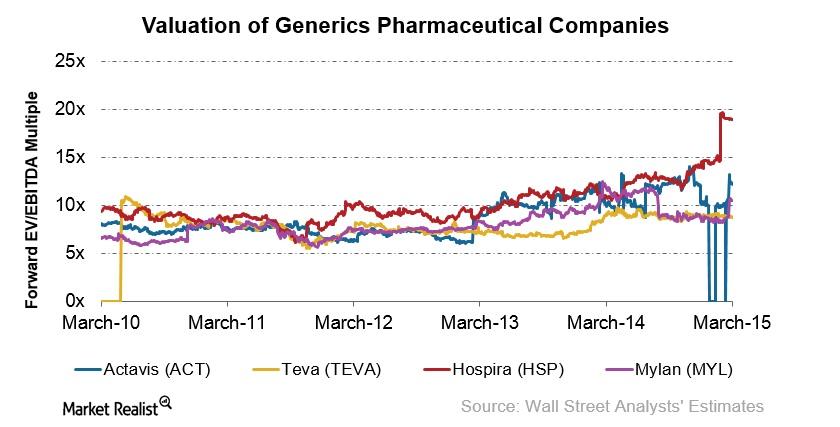

What Drives Generic Pharmaceuticals’ Valuation?

Valuation reflects the market’s perceptions of the industry’s growth prospects. The major value drivers for valuation are ROIC and the growth rate.

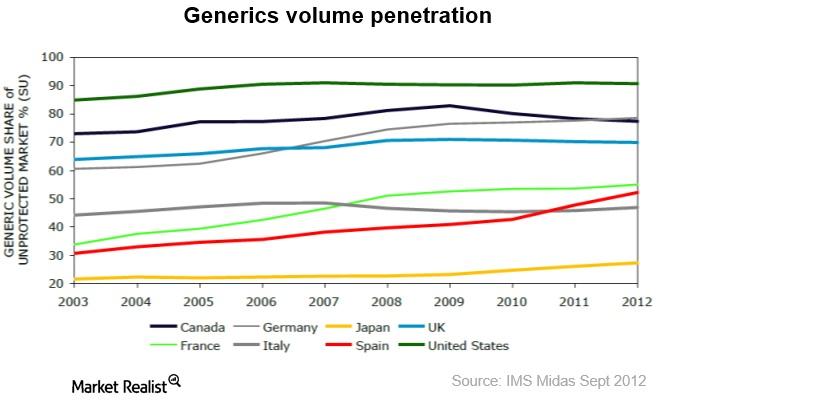

What’s Supporting Continued Growth in the Generics Market?

The global generics market was valued at $168 billion in 2013. From 2013 to 2018, it’s expected to grow at a CAGR of 11% to reach $283 billion.

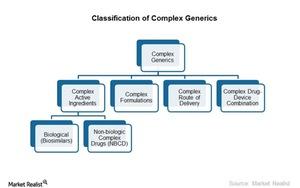

Complex Generics Are Attractive Due to High Margins

Complex generics are large and complex formulations or active ingredients used to treat chronic and life threatening diseases like cancer, Hepatitis C, and HIV.

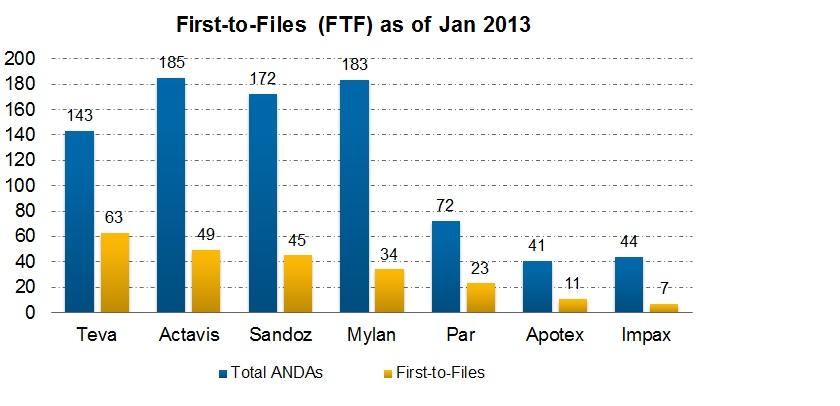

Is a Para IV Filing Rewarding for a Generic Company?

A generic company is rewarded for a Para IV filing. The first applicant to submit a substantially completed ANDA is given marketing exclusivity for 180 days.

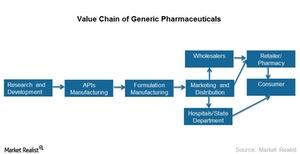

Generics Are Climbing up the Value Chain

Severe cost pressure can lead to the commoditization of generics. it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

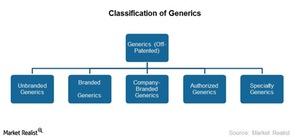

Why the Generic Industry’s Classification Is Still Evolving

The generics industry primarily caters to several large diseases in primary care. Healthcare is organized into three categories—primary, secondary, and tertiary.

Are Generics the Only Affordable Drugs?

Drugs are used to treat, cure, or prevent diseases. The drug market is broadly categorized into prescription drugs and OTC (over-the-counter) drugs.

What Investors Need to Know about Branded and Generic Drugs

The prescription drug market is divided into two categories—branded or generic drugs. Branded drugs are patented drugs. Generics are off-patented drugs.