Falling oil prices affect energy upstream and integrated companies

Falling oil prices have started to affect energy upstream companies’ revenues. These companies have resorted to cutting costs and focusing on cash flow.

March 19 2015, Updated 1:06 p.m. ET

Falling crude tightens balance sheet

Revenues for upstream energy companies are closely tied to energy price movements. Falling oil prices have started to affect those revenues. These companies have resorted to cutting costs and focusing on cash flow.

The sharp decline in the price of crude oil has led energy companies to focus on maintaining healthy cash balances, strengthening their balance sheets, and meeting debt covenants.

The Bloomberg Intelligence North America Independent Exploration & Production Index lost 55% since crude peaked in June. This wiped out $343 billion in market value. The index includes 57 US and 17 Canadian companies.

Energy returns slide

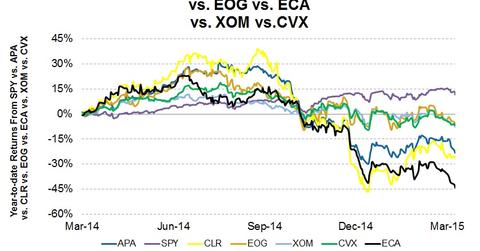

Returns from holding upstream and integrated companies’ stocks have also diminished. All the upstream and integrated energy companies in our selection have underperformed the broad market index.

Returns comparison

Compared to 11.6% returns from the SPDR S&P 500 ETF (SPY) in the past one year, upstream majors such as Apache Corporation (APA), Continental Resources (CLR), EOG Resources (EOG), and Encana Corporation (ECA) have produced -23.4%, -26.8%, -6.5%, and -43.7%, respectively, in the past one year.

Integrated energy giants such as Exxon Mobil (XOM) and Chevron Corporation (XOM) have returned -7.7% and -6.8%, respectively, during the same time frame. APA and EOG make up 5.5% of the Energy Select Sector SPDR ETF (XLE).

Also note that returns from energy stocks have fallen sharply since late June when the price of crude oil started to tumble. Many of these companies have increased debt burden over the past few years. Read on in this series to find how that can affect these companies.