Eminence Capital Reduces Position in Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The company accounted for 1.33% of the fund’s 4Q14 portfolio.

Dec. 4 2020, Updated 10:52 a.m. ET

Eminence Capital and Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The fund held 637,766 shares of HUM, which accounted for 1.33% of the fund’s 4Q14 portfolio. The company had made up 2.24% of the fund’s 3Q14 portfolio with 1,173,871 shares.

About Humana

Humana is a leading healthcare and well-being company. It is a private managed care organization. As of December 31, 2014, HUM had about 13.8 million members in its medical benefit plans and roughly 7.7 million specialty products users.

The company serves a range of customers:

- Medicare beneficiaries

- Medicaid recipients

- Tricare beneficiaries

- groups insured by employers

- private individuals

According to the Centers for Medicare & Medicaid Services (or CMS), Humana was responsible for about 70% of individual Medicare Advantage (or MA) net enrollment growth in January. People sign up for MA—a substitute for the original Medicare program—via private health insurance companies. Peers of HUM such as Aetna (AET), UnitedHealth Group (UNH), and Cigna (CI) focus more on commercial enrollments.

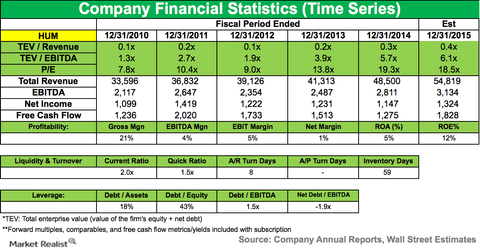

Strong revenue growth for 4Q14

For the fourth quarter of 2014, Humana reported revenue of $12.3 billion, up 21% year-over-year (or YoY). $8.65 billion of this revenue came from the MA program. Commercial health plans represented 18% of total revenue.

Net income for 4Q14 was $145 million compared to a net loss of $30 million in 4Q13. Adjusted diluted earnings per share (or EPS) were $1.09, up 36% YoY. This was mainly due to a reduced number of shares, which resulted from the share repurchase.

Individual MA enrollments were up 18.2% YoY to 2.4 million. 73% of the individual MA net growth was from health maintenance organization (or HMO) offerings.

For the full year 2014, EPS was $7.51. This was just above the midpoint of the guidance given by management.

For the full year 2015, Humana expects earnings of $8.50 to $9 per share with an increase of 17% at the midpoint.

Returns to shareholders

HUM is planning to buy back $1 billion of stock by June 2015. The company has already repurchased $630 million in shares.

On February 18, HUM declared a quarterly dividend of $0.28, which was in line with previous offerings. For more diversified exposure, investors can invest in the Health Care Select Sector SPDR Fund (XLV). HUM accounts for 0.9745% of XLV.

Drop in Medicare funding for 2016

In February, the CMS estimated that Medicare funding could decrease by 0.95% in 2016. According to the Wall Street Journal report that followed this announcement, HUM and its peer Aetna were also expecting Medicare funding to fall next year. According to HUM, funding will likely fall by 1.25%–1.75%. AET expects funding to drop by 1%.

To learn more about HUM, read the Market Realist series Humana’s valuations exceed Anthem, Aetna, and Cigna in 4Q14.

In the next part of this series, we’ll discuss Eminence Capital’s position change in Valeant Pharmaceuticals International.