Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

Nov. 20 2020, Updated 12:05 p.m. ET

What are indicators?

Stock prices are driven by various parameters. The economy drives some of these movements. We can explain other movements with the industry scenario. Some of these movements are driven by company-specific factors. The other movements either remain unexplained or can be understood through technical and behavioral factors.

Our Macro page discusses macroeconomic factors. At times, we also cover company-specific factors—such as earnings and major developments. To help you understand industry dynamics, we publish industry primers and other industry pieces.

As their name suggests, indicators show what could happen to the industry in the short-to-medium term—within the next six months.

Why are we covering these indicators?

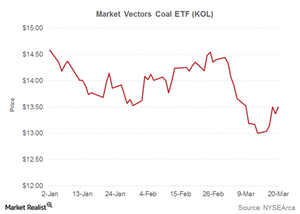

Market Realist believes in long-term investing. Why should short-term movements matter in the first place? Well, we believe that, even for a long-term investor, entry and exit timing is important. When an investor wants to invest in or sell stocks (SPY) from a particular industry—like coal (KOL)—indicators can provide valuable clues about whether to invest, sell, or wait a few more days.

Why are we combining thermal coal and power indicators?

Thermal coal is mostly used for electricity generation. So the state of utilities sector is by far the biggest driver of the coal industry, apart from factors such as competition from natural gas.

Even for power utilities, coal remains the preferred fuel—at least for now—despite the shale gas boom.

So, looking at both industries together makes more sense. This way, we’ll be able to determine the impact of a particular variable, like natural gas prices, on coal companies such as Arch Coal (ACI) and Peabody Energy (BTU) as well as utilities such as AES (AES) and Southern (SO).