AES Corp.

Latest AES Corp. News and Updates

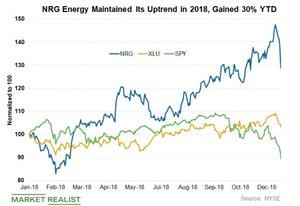

NRG Energy’s Valuation Compared to Its Peers

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019.

Not All Utility Stocks Are Overpriced

Utility stocks seem overvalued. Utilities have reached record levels. They have been trading at inflated valuations for months.

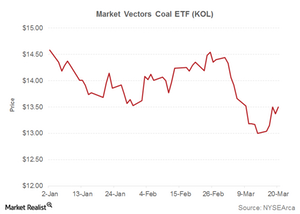

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.Energy & Utilities Must-know: Risks to AES Corporation’s business

Given the nature of its business, AES Corporation (AES) faces risks relating to currency fluctuations, fuel prices, interest rates, and a scattered business model.Energy & Utilities Why electricity demand is linked to GDP

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.

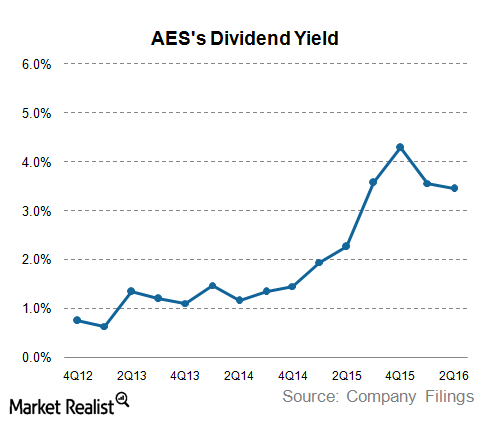

A Look at AES’s Dividend Yield

AES’s (AES) dividend yield has improved significantly in the last couple of years. The 10% fall in dividends in 2016 is among one of the highest in the industry.

How Does AES Corporation Categorize Its Businesses?

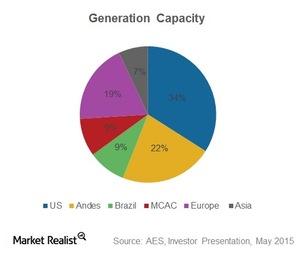

AES Corporation (AES) is a diversified power generation and utility company. It operates its business under six SBUs (strategic business units).

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.

AES Corporation: Its Evolution Up until Now

AES Corporation is a global entity and operates through its six strategic business units, created based on the geographical areas they cater to.