Valuing homebuilders: Buying at the right price

Homebuilders earn substantial profits buying land at a cheaper rate, allowing it to appreciate over time, constructing a house on it, and selling it.

March 9 2015, Updated 4:05 p.m. ET

Relative valuation method

Homebuilders’ balance sheets are primarily asset-driven. Land held for development and its development costs as well as residential lots held for sale or construction can comprise a large proportion of their total assets. The main items on homebuilders’ balance sheets are accounts receivable, housing inventories, property plants and equipment, and investments.

Why use book value?

Homebuilders earn substantial profits buying land at a cheaper rate, allowing it to appreciate over time, constructing a house on it, and selling it. Basic construction costs have remained more or less the same for most builders, unless the amenities they provide are very luxurious. The main differentiating factor remains the acquisition of land at cheaper rates. So analysts often use adjusted book value to arrive at a valuation for homebuilders.

Book value is the value of a company’s assets expressed on its balance sheet. In the adjusted book value, assets are adjusted to reflect their fair market value. The adjusted price-to-book value ratio, expressed as a multiple, shows how much shareholders are paying for a company’s net assets. A low price-to-value ratio is always preferable, as you can buy the stock for very close to its book value.

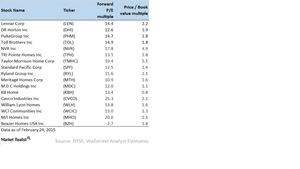

An earnings-based approach, using a price-to-earnings (or PE) multiple and enterprise value–to–earnings before interest, taxes, depreciation, and amortization (or EV/EBITDA) multiples can also find use supporting the price-to-book value multiple. Homebuilders stocks can become highly volatile and trade at a very high PE multiple during bad times, and the opposite is true during good times.

Fundamentals tell the story

Comparing the above multiples with their industry average can also show some interesting facts. For example, the homebuilding industry is trading at an average PE multiple of 12, while stocks such as Lennar (LEN) and D.R. Horton (DHI) are trading almost in line with the industry average. Similarly, the price–to–book value multiple for the homebuilding industry is 1.8, while many stocks—such as KB Home (KBH)—are trading below their industry average.

Homebuilder ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares U.S. Home Construction ETF (ITB) take considerable exposure to homebuilder stocks when their perceived valuation is low or future return expectations are higher.