Greek Debt Crisis 101: Getting To The Crux Of The Matter

According to estimates by EuroStat, Greek debt stood at more than 315 billion euros at the end of September 2014.

May 3 2021, Updated 10:57 a.m. ET

With the Greek election over, market attention will now turn to how the new government manages their debt negotiations with the troika—the ECB, European Commission and International Monetary Fund. Here is a breakdown of what is at play and what to look for in the coming weeks.

The gap between Greece and its creditors. At around 180% of the gross domestic product, Greece’s debt is unsustainable over the long term. Newly minted Prime Minister Alexis Tsipras campaigned on the promise of seeking a write-down on the country’s debt, a “haircut” so to speak, which many European finance and government officials have dismissed as out of the question. A more likely offer from the troika: a deadline extension for Greece to qualify for its next bailout aid installment.

Market Realist –

What is the magnitude of Greek debt?

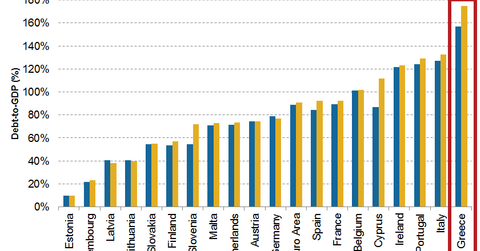

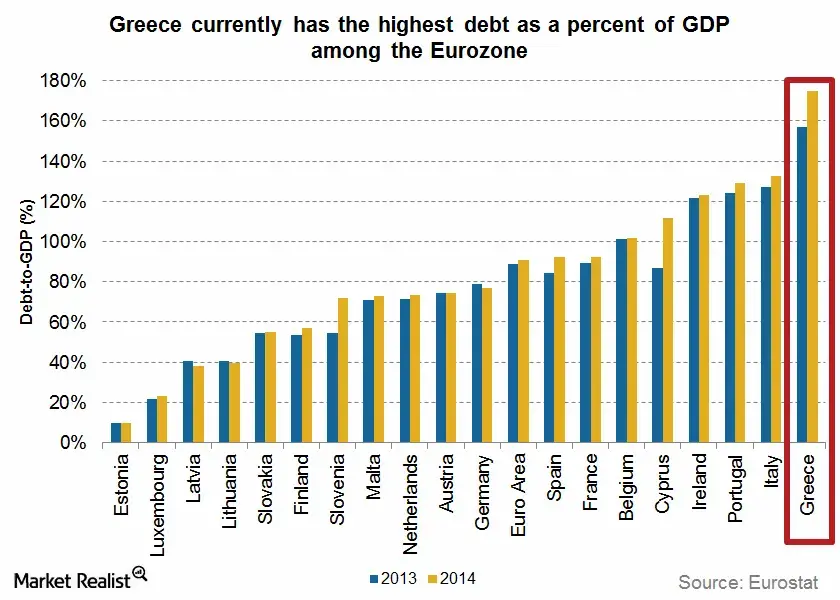

According to estimates by EuroStat, Greece’s (GREK) debt stood at more than 315 billion euros at the end of September 2014. The European Financial Stability Facility (or EFSF) estimates it to be 324 billion euros. This puts the Greek debt between 175 and 177% of Greece’s GDP, and right at the top of the list in the Eurozone (EZU) (VGK), as the above graph shows. The magnitude of the debt is enormous and most economists consider it to be unsustainable.

Who are the creditors of the mammoth Greek debt?

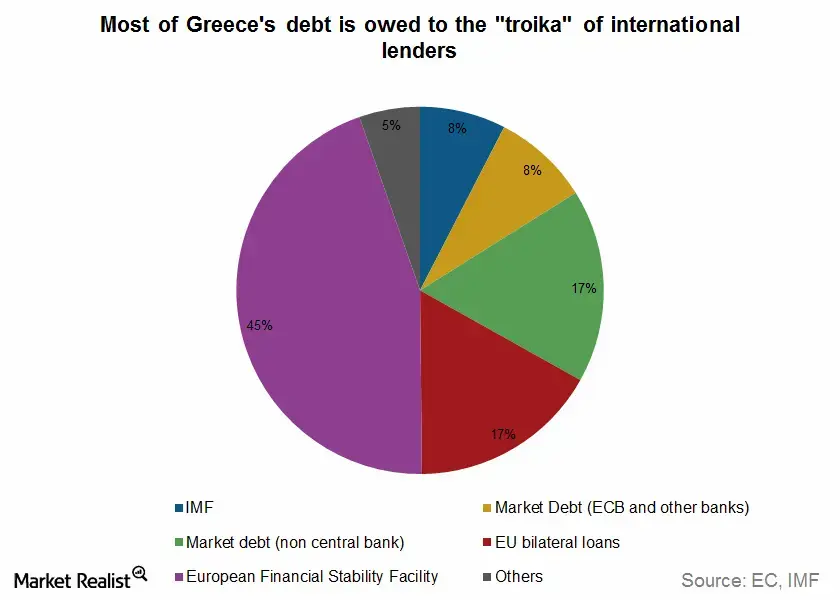

The troika includes the EFSF, the International Monetary Fund (or IMF), and the European Central Bank (or ECB), making up almost 80% of Greece’s lenders. The above graph shows the breakup of the creditor composition.

The EFSF was formed in 2010 to aid the ailing Eurozone economies and currently holds almost 45% of the Greek debt, making it the biggest creditor. The ECB and the IMF hold approximately 25 billion euros each of Greek debt. Eurozone economies are exposed to Greek debt in the form of guarantees and bilateral loans to the tune of each of their weight of capital holding. Germany (EWG) and France (EWQ) have guaranteed 40 and 31 billion euros, respectively. Germany’s exposure to Greek debt has been estimated to be 56 billion euros.

The Greek debt impasse

The 240 billion euro bailout program comes to an end on February 28. Greece’s creditors want the country to apply for an extension to the bailout to dismiss the possibility of a default. Greece on the other hand wants a “bridge agreement”. Greece does not wish to apply for an extension.

The austerity stipulations of the bailout program that called for an increase in budgetary surplus and cuts in public spending have pushed Greece into a recession deeper than what was seen in the aftermath of the US financial crisis. Tspiras, the Greek Prime Minister, has called the austerity reforms a “toxic fantasy” and is calling for the scrapping of almost a third of the austerity commitments, and a modest budgetary surplus target of 1.5%.

Read on to the next part of the series to understand the motivations behind the Greek government’s call to scrap the austerity measures.