Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

June 25 2015, Updated 5:31 a.m. ET

Direct Banking

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small. It contributes less than 3% to the company’s total revenue. A direct bank doesn’t have a branch network. It offers services remotely through online and telephone banking. Discover’s Direct Banking segment offers the following main products and services:

- credit cards

- student loans

- personal loans

- home loans and home equity loans

- deposits

Credit Cards

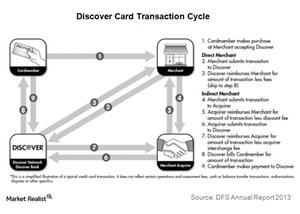

Discover offers credit cards to consumers and small businesses. Interest on credit card loans makes up 85% of the company’s total interest income. The company processes its credit card transactions in US over its own network. The above chart illustrates how the Discover card transaction cycle is processed on the Discover Network.

Other large banks include JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), and Wells Fargo (WFC). All of these banks offer consumer banking services. Together, these four banks form ~27% of the Financial Select Sector SPDR ETF (XLF). We’ll discuss Discover’s direct banking focus in more detail later in this series.

Payment Services

Discover’s Payment Services offer the following main products and services:

- PULSE – It’s an ATM or debit network. It links cardholders of ~6,000 financial institutions, including big banks, with ATMs and POS (point of sale) terminals located throughout the US. PULSE also provides cash access at ATMs in over 120 countries.

- PULSE’s primary source of revenue is transaction fees charged for switching and settling ATM, PIN (personal identification number) POS debit, and signature debit transactions initiated through the use of debit cards issued by participating financial institutions.

- When a financial institution joins the PULSE network, debit cards issued by that institution are eligible to be used at all of the ATMs and PIN POS debit terminals that participate in the PULSE network.

- Diners Club – The subsidiary provides charge and credit cards targeting affluent individuals who travel frequently across countries. It provides a range of payment options, benefits, and exclusive offers to customers in partnership with merchants, restaurants, and service providers around the world.

It has an acceptance network in over 185 countries through ~80 licensees—generally financial institutions. The company generates revenue through royalties paid by the licensees.

In the next part of this series, we’ll discuss Discover’s fourth quarter earnings. We’ll see how the fourth quarter earnings impacted Discover’s stock price.