2 key business models of the health insurance industry

The health insurance industry runs on two business models: traditional insurance and managed care organizations.

Feb. 5 2015, Updated 4:06 p.m. ET

Health insurance

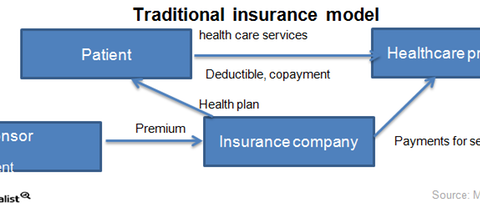

The health insurance industry, part of healthcare industry represented by the Healthcare Select sector SPDR (XLV), runs on two business models: traditional insurance and managed care organizations. Traditional insurance or indemnity health plans account for about 10% of the total health insurance market in the US. The remaining 90% of plans come from managed care organizations.

Traditional insurance

In the traditional insurance model, when the patient visits a healthcare provider, a hospital, or a physician for the first time in the calendar year, they pay an amount called the “deductible” as described in the health plan. The deductible is the amount to pay before the insurer starts paying for medical services. After the deductible, the enrollee also pays the copayment, which is the amount members pay when they use a particular type of health service. The insurance company pays the remaining bill.

Managed care organizations

Managed care organizations such as Aetna (AET), Humana (HUM), Cigna (CI), and UnitedHealth Group (UNH) mostly sell health maintenance organization (or HMO) plans or preferred provider organization (or PPO) plans. Managed care organizations contract with a network of healthcare providers and negotiate for a discount on hospital prices. Depending on the market share in total enrollments and the strength of the hospital network, either the managed care organization or the healthcare provider benefits more from the negotiated price.

With an HMO plan, a patient first visits an assigned primary care practitioner (or PCP) who helps control their use of medical services. Only after being referred by a PCP can a member approach a specialist. Both the primary physician and the specialist receive payments from the managed care organization and the patient as the copayment and deductible.