Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

June 23 2015, Updated 11:06 a.m. ET

The loan-to-deposit ratio

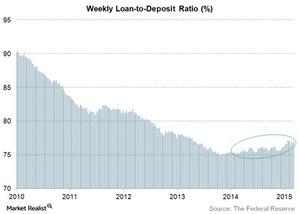

According to the latest Federal Reserve data released on June 12, the loan-to-deposit ratio at all US commercial banks in the week ending June 5, 2015, was 76.9%. The ratio was 76.8% in the previous week.

The loan-to-deposit ratio is commonly used to assess a bank’s liquidity. It’s calculated by dividing a bank’s total loans by its total deposits. A very high ratio indicates that a bank doesn’t have enough liquidity to cover any unforeseen needs. A very low ratio might indicate that a bank isn’t earning as much it can on deposits.

The industry-wide loan-to-deposit ratio has declined over the last few years. The above chart shows the loan-to-deposit ratio at all US banks. One factor that’s contributing to the lower ratio is an increase in non-interest-bearing bank deposits, which we learned about in the last part of this series.

Banks don’t use all of these funds to make loans because they need to keep some funds available for withdrawals. Deposits have grown at a much faster rate than loans over the last few years.

The ratio is improving

As the above graph shows, the loan-to-deposit ratio indicates a slight upward trend since 2014. In 2015, it improved significantly—mainly due to the decline in deposit growth and decent loan growth. A very low industry-wide ratio may indicate that banks aren’t earning as much as they can on deposits.

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios. U.S. Bancorp’s ratio is around 90%.

The ratio is lower at banks such as J.P. Morgan (JPM) due to its significant custodian banking operations that require it to hold more liquid assets.

The ratios at Citigroup (C), Wells Fargo (WFC), and Bank of America (BAC) lie somewhere between U.S. Bancorp’s and J.P. Morgan’s.

Combined, Citigroup, Wells Fargo, and Bank of America account for ~19.5% of the Financial Select Sector SPDR Fund (XLF).