Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

Nov. 20 2019, Updated 2:59 p.m. ET

Big commercial loan portfolio

At the end of 2013, commercial loans accounted for more than 40% of Bank of America’s (BAC) loan portfolio. Bank of America has the largest commercial credit portfolio compared to its peers JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C).

Wells Fargo leads in the commercial real estate segment but closely follows Bank of America when it comes to overall commercial credit. US Bancorp (USB), which is part of the Financial Select Sector SPDR ETF (XLF), has a larger commercial loan portfolio than Citigroup (C).

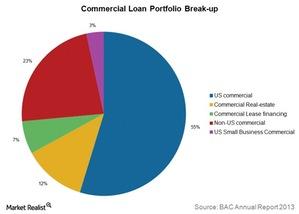

US commercial loans account for more than half of Bank of America’s commercial credit portfolio. Non-US commercial loans contribute the second highest to the portfolio. The above chart provides a break-up of the bank’s commercial loan portfolio.

Diversification reduces risk

Bank of America (BAC) considers a number of factors before granting commercial loans. In addition to assessing the credit profile of the borrower, the bank ensures that loans aren’t too concentrated by industry, geography, or customer. The bank’s commercial credit exposure is diversified across industries. Its largest industry concentration is in diversified financials, followed by real estate. Diversification reduces risk.

Performance of the non-US commercial loan portfolio might be impacted by economic and political conditions, currency fluctuations, and other country-specific factors. The bank considers exposure by region and country for its non-US portfolio.

Europe accounts for the highest non-US exposure, with 53% of the total non-US commercial loans concentrated in Europe at the end of 2013. The Asia Pacific region accounted for the second highest non-US exposure.

Commercial real estate mostly includes commercial loans and leases secured by nonowner-occupied real estate. Bank of America’s (BAC) commercial real estate loans are diversified across geography. At the end of 2013, the state of California, which represented the largest state concentration, accounted for 22% of the bank’s total commercial real estate loans.

In the next part of the series, we’ll take a look at Bank of America’s (BAC) residential loan portfolio and see how it compares with its peers’.