How does Bank of America make money?

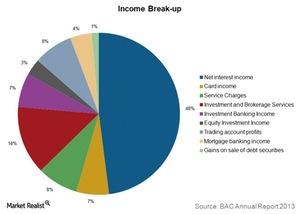

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

Nov. 20 2019, Updated 3:04 p.m. ET

Interest and noninterest income

Every bank earns income on loans and other earning assets and pays interest on deposits and other interest-bearing liabilities. Deducting interest paid from the total interest earned gives net interest income.

Net interest income contributes about half of Bank of America’s (BAC) total income. The remaining half, known as noninterest income, is made up of charges for a host of other services the bank provides.

The above chart provides a breakdown of Bank of America’s (BAC) total income by type. Now let’s take a look at the bank’s noninterest income.

A summary of Bank of America’s noninterest income

Investment and brokerage services contribute the most to Bank of America’s (BAC) noninterest income. Investment and brokerage services primarily include asset management fees and commissions on the sale of financial products. Service charges, which include fees for insufficient funds, overdrafts, and other banking services, contribute the second most of the bank’s noninterest income.

Derivatives, debt, and equity securities bought principally with the intent to buy and sell in the short term are held in a trading account. Trading account profits include profits or losses on the bank’s trading activities in derivatives, currencies, commodities, and debt and equity securities. Changes in fair values of assets held in trading accounts are also recognized in the account profits. Trading account profits accounted for a substantial portion of Bank of America’s (BAC) noninterest income in 2013.

The next highest revenue contributors are card income and investment banking income. Card income includes fees such as cash advance, annual fees, late fees, over-limit fees, and other miscellaneous fees on the bank’s credit and debit cards. Bank of America’s investment banking activities include debt and equity underwriting and distribution as well as merger-related and other advisory services.

Bank of America’s (BAC) mortgage banking activities include origination, funding, and servicing of mortgage loans. Equity investments include a portfolio of global equity, real estate, and alternative investments. These are either direct investments in companies or invested through funds.

Diversified income sources

Bank of America (BAC) has a diversified revenue base just like its peers JPMorgan Chase (JPM) and Citigroup (C). If any segment performs poorly due to market conditions, the overall revenues don’t get hit too hard. This might happen with some of the smaller banks in the Financial Select Sector SPDR ETF (XLF) such as U.S. Bancorp (USB) that operate in only one or two segments.

In the next part of this series, we’ll look at Bank of America’s (BAC) consumer banking operations.