Novartis’s Valuation Compared to Its Peers’

Novartis’s valuation has followed the industry’s overall trend over the last five years. Whether the healthcare sector’s valuation rises or falls, Novartis will definitely be affected.

March 24 2017, Published 3:07 p.m. ET

A look at Novartis

Novartis (NVS) is one of the largest pharmaceutical companies by revenue. It’s headquartered in Basel, Switzerland.

The company specializes in the research, development, manufacturing, and marketing of a broad range of healthcare products. It deals in both prescription drugs and over-the-counter drugs.

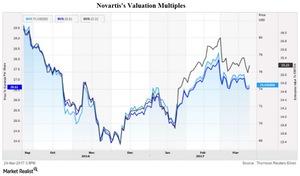

We believe that the forward PE (price-to-earnings) and EV-to-EBITDA (earnings before interest, tax, depreciation, and amortization) multiples are the two best valuation multiples to use when valuing Novartis and other large pharmaceutical companies, given the relatively stable and visible natures of their earnings.

Forward PE

PE multiples are widely available and represent what one share of a company can buy for an equity investor. On March 24, 2017, Novartis was trading at a forward PE of ~15.5x. The industry is currently trading at a forward PE of ~14.9x.

Novartis’s valuation multiple has followed the industry’s overall trend over the last five years. Whether the healthcare sector’s forward PE multiple rises or falls, Novartis will definitely be affected. Other competitors Pfizer (PFE), Eli Lilly (LLY), and GlaxoSmithKline (GSK) have forward PEs of 13.5x, 20.2x, and 15.2x, respectively.

EV-to-EBITDA

On a capital structure–neutral basis, Novartis is currently trading at ~14.4x, much higher than the industry average of ~10.2x. Other competitors such as Pfizer (PFE), Eli Lilly (LLY), and GlaxoSmithKline (GSK) have forward EV-to-EBITDA multiples of 10.2x, 14.4x, and 9.6x, respectively.

To divest company-specific risk, investors can consider ETFs such as the First Trust Value Line Dividend ETF (FVD), which holds ~0.5% of its total assets in Novartis, 0.5% in Johnson & Johnson (JNJ), and 0.5% in Pfizer (PFE).