Key update on Antero Midstream’s assets

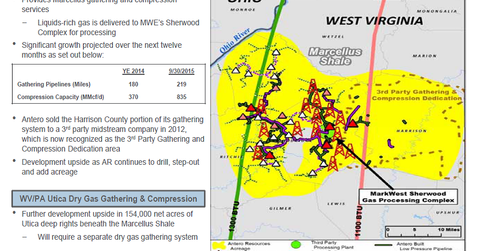

Antero Resources’ current acreage is focused in the Marcellus Shale in West Virginia and the Utica Shale in Ohio.

May 4 2021, Updated 10:14 a.m. ET

Antero’s assets

Antero Resources’ (AR) current acreage is primarily in the Marcellus Shale in West Virginia and the Utica Shale in Ohio. According to a company presentation, Antero has 37.5 Tcf (trillion cubic feet) of 3P reserves in the Marcellus and Utica Shales combined.

Antero Midstream (AM) owns gathering and compression assets in these areas and the sole purpose of these assets is to service Antero Resources, Antero Midstream’s sole customer.

Marcellus gathering and compression

Marcellus is one of the largest shale gas plays in the world. The company notes that it is the most active driller in the Marcellus Shale with 15 rigs.

Antero’s net proved reserves in the Marcellus Shale is 8.5 Tcf and net 3P reserves are 26.4 Tcf. 3P reserves are proven reserves plus probable and potential reserves, or unproven reserves. Total Marcellus acreage is 386,000.

Utica gathering

Utica assets provide natural gas and condensate gathering services to Antero’s resources in the Utica Shale.

According to a company presentation, Antero is the second most active driller in the Utica Shale with 7 running rigs. Net proved reserves are 537 Bcf (billion cubic feet), while net 3P reserves are 6.4 Tcf. Net Utica acreage is 134,000.

Antero Midstream’s revenue and guidance

These assets will be under 100% fixed fee long-term contracts with Antero Resources. Antero Midstream’s revenues would be generated via these fixed fees.

Antero resources forecasts that production will increase by 45-50% in 2015 and 2016. This would be positive for Antero midstream as well and boost the earnings of the midstream company.

Key ETFs

Antero Midstream is a subsidiary of Antero Resources, which is a component of several energy ETFs, including the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the iShares US Energy ETF (IYE), and the Vanguard Energy ETF (VDE).

The following part of the series looks at the similarities between the Shell and Antero IPOs.