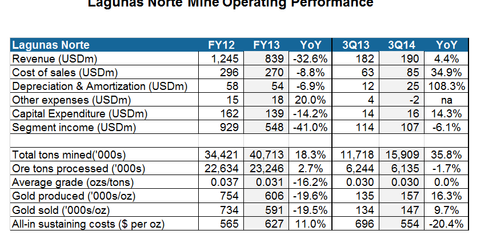

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Nov. 20 2020, Updated 12:52 p.m. ET

The Lagunas Norte mine

The Lagunas Norte mine is located on the Alto Chicama property in north-central Peru. It is an open-pit operation with an average mining rate of 111,500 tons per day. Gold and silver recovered from the ore are smelted into doré on-site and shipped to an outside refinery for processing into bullion. It’s one of Barrick Gold Corporation’s (ABX) lowest-cost mines.

For more about doré, read Market Realist’s Investing in gold: A must-read value chain analysis.

Barrick Gold’s (ABX) peer, Newmont Mining Corp (NEM), runs Yanacocha mine in Peru, which is also aging and hit by dwindling reserves. Other companies, including Goldcorp Inc. (GG), Agnico Eagle Mines Ltd (AEM), and Kinross Gold Corporation (KGC), are also feeling the effects of shrinking reserves.

Strong operating performance

Lagunas Norte produced 157,000 ounces of gold in 3Q14, which is 15% higher than 3Q13. Production was higher in the third quarter due to processing higher-grade material and a faster leach cycle (time taken to separate precious metals, including gold from its ore) from stacking ore on the new area of the leach pad. All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Higher grades will benefit 4Q14 production

Fourth-quarter production is expected to benefit from higher grades. Production in 2014 is anticipated to be 570,000 to 610,000 ounces. AISC guidance has been reduced to $590 to $620 per ounce, from $640 to $680 previously, because of a decrease in sustaining capex.

The VanEck Vectors Gold Miners exchange-traded fund (or ETF) (GDX) invests in all the above-mentioned stocks, while the Standard and Poors depositary receipt (or SPDR Gold Trust ETF (GLD) provides exposure to the spot gold prices.