Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

May 3 2021, Updated 10:55 a.m. ET

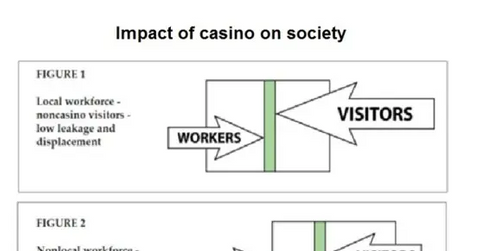

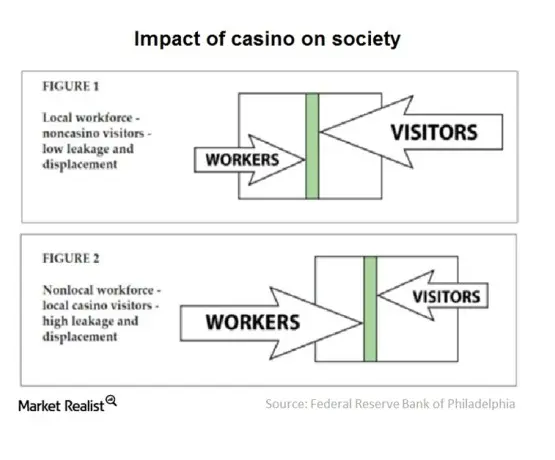

Leakage effect

Casinos can impact the society where they’re located. The size of the effect depends on how many visitors the casino draws from outside the area. It also depends on the number of jobs the casino generates within the area.

Casino revenues that support jobs and purchases are generated by casino visitors’ spending. The jobs and purchases generate funds. These funds are diffused into the community. The funds have secondary or multiplier effects in subsequent rounds of spending. There’s a second category of direct and secondary effects. They include the non-casino expenditures generated from visitors outside the area. These non-casino expenditures include purchases in local stores or meals in local restaurants.

A variety of factors impact the degree of the direct and secondary effects experienced outside the local area. This occurs when a casino purchases supplies from an out-of-area vendor. It also occurs when a casino hires a worker who commutes to the casino from outside the community. The individual takes the income they made at the casino and spends it outside the local area. This is a phenomenon known as “leakage.”

Displacement effect

The positive economic impact is offset by other local economic activity. It’s negatively affected by the casino. The casino could cause a loss of a business in the existing local economy. For example, an existing restaurant could lose business to a restaurant that’s located inside the casino. Also, local residents could take money that they would spend for other purposes and redirect the funds to the casino. This is referred to as “displacement.” Casino-related spending displaces or substitutes other forms of spending.

Social cost

Social costs impact major players including Las Vega Sands (LVS), MGM Resorts, Wynn Resorts (WYNN), and Caesar Entertainment (CZR). Social cost includes is the increase in corruption or organized crime. Casinos offer gambling for entertainment. However, they also have financial activities that are similar to financial institutions. These activities put casinos at risk for money laundering. This could be controlled through careful regulations.

Exchange-traded funds (or ETFs) like the VanEck Vectors Gaming (BJK) and the Consumer Discretionary Select Sector SPDR Fund (XLY) track leisure companies.

To know more about the casino gaming market performance click here.

To access our premium industry primers, company overviews and financial models, please email premium@marketrealist.com. Specify the industry or company ticker(s) you are interested in and a representative will get in touch with you.

Discretionary consumer spending effect

The casino business is sensitive to reduced consumer spending. Reduced spending can be caused by economic downturns. Consumer demand for hotels, casino resorts, and luxury amenities is also impacted by the state of the economy.

This could impact major casino players like Las Vegas Sands (LVS), MGM Resorts (MGM), Melco Crown Entertainment (MPEL), and Caesar Entertainment (CZR). Exchange-traded funds (or ETFs) like the VanEck Vectors Gaming (or BJK) and the Consumer Discretionary Select Sector SPDR Fund (XLY) track the performance of leisure companies. The ETFs could also be impacted by an economic downturn.

The above chart shows that in 2012, consumers spent more at commercial casinos than they did on movies, craft beer, and outdoor equipment combined. However, consumers spent less on casino gambling than what they spent on full-service restaurants or consumer electronics.

Changes in discretionary consumer spending could be caused by many factors. These factors include:

- weaknesses in the job or housing market

- additional credit market disruptions

- high energy costs

- fuel and food costs

- increased travel costs

- the potential for bank failures

- recession fears

- changes in consumer confidence in the economy

- fears war and terrorism

These factors could reduce consumer demand for luxury amenities and leisure activities.

Political effect

The casino business is prone to extensive regulations. The compliance costs—or the cost of not complying with regulations—may have a negative impact on the business, financial conditions, operations, or cash flows.

The casino business is sensitive to customers’ willingness to travel. As a result, acts of terrorism, regional political events, and conflicts in other countries could disrupt air travel. This would reduce the number of casino visitors. Fewer visitors could hurt the casino’s financial conditions, operations, or cash flows.

The business is also subject to taxation and regulation by various government agencies—primarily in Macao, Singapore, and the U.S. The government agencies include the federal, state, and local levels. U.S. federal, state, local, and foreign governments change tax rules. Changing rules could result in higher taxes than existing tax laws. Changes in tax laws and regulations could have a severe impact on the business’ financial condition and operations.

How does it work?

The right location has to be selected before a casino is built. The local zoning laws have to be checked to make sure they will allow a casino in the area. The casino has to register with the city and state. It also has to get the required licenses and employer identification number (or EIN).

The capital that the casino raises could be invested to get gaming equipment like slot machines, video poker machines, roulette tables, poker tables, blackjack tables, craps tables, baccarat tables, chips, cards, and card shoes.

Advertisement is important for a casino. Television and radio commercials draw attention to the casino. Internet advertisements also increase tourism and recreation.

The above chart shows how an accurate business plan and enough funding make sure that a casino is established correctly. Generated revenue is used to meet business costs—like license fees, capital expenditures, and wages. The revenue is also used to distribute the free cash flow to the shareholders—through dividends and share buybacks. If there’s any remaining free cash flow, the business keeps it. The business uses it to provide for more growth. It can also use it to meet any contingent liability.

Licensing requirements

Three types of licenses are required to run a casino:

- Operating license – This is required to run a casino or offer casino games—for example, running a website that offers poker, roulette, and blackjack.

- Personal license – There are two kinds of personal licenses—the personal management license (or PML) and personal functional license (or PFL). PML is for individuals who are responsible for specific areas in the organisation. Casino employees would have to apply for PFL if they are involved in gaming or handling gambling money.

- Premises license – This is required to run small or large casino. It’s also required to run an existing casino. It’s issued by the local licensing authority.

Key stocks and exchange-traded funds (or ETFs)

Key players in the casino industry include Las Vegas Sands (LVS), MGM Resorts (MGM), Penn National Gaming (PENN), and Melco Crown Entertainment (MPEL). Exchange-traded funds (or ETFs) like the Consumer Discretionary Select Sector SPDR Fund (XLY) and the VanEck Vectors Gaming (or BJK) track leisure companies.

To learn more, see Why minor revenue changes greatly impact a casino firm’s value.

To access our premium industry primers, company overviews and financial models, please email premium@marketrealist.com. Specify the industry or company ticker(s) you are interested in and a representative will get in touch with you.

Casino visitors’ demographics

The commercial casino industry plays a vital role in the overall U.S. travel and tourism industry. Roughly a quarter of the U.S. adult population visits a casino at least once a year. Casinos attract a substantial number of overseas visitors.

Today’s casinos—including Las Vegas Sands (LVS), MGM Resorts (MGM), Caesar Entertainment (CZR), and Pinnacle Entertainment (PNK)—provide top-notch entertainment experiences that go beyond gaming. Exchange-traded funds (or ETFs) like the VanEck Vectors Gaming (or BJK) and the Consumer Discretionary Select Sector SPDR Fund (XLY) track the leisure companies.

Modern casinos have diverse amenities. The amenities attract a variety of tourists. The tourists also visit neighboring attractions. This stimulates the local economy.

The above chart shows that young people aged between 21–35 visit casinos the most. Nearly four out of ten individuals in the age group went to a casino in 2012. However, this visitation rate is only slightly higher than respondents aged between 50–64 at 36% and those aged between 36–49 at 34%. Only a quarter of older Americans aged 65 and over visited a casino during 2012.

What’s your total household income?

The above chart shows that casino visitors have similar household incomes compared to national survey respondents. Casino visitor households make slightly more. Nearly 50% of all casino visitors’ households make more than $60,000 per year. Only 34% of households in the overall national sample have the same annual income. Household incomes for young adult casino visitors are almost in line with the broader population of casino visitors.

Casino gambling is an activity that adults aged 21 and over enjoy every day across the U.S. However, there are underlying differences. Young adult casino visitors, as a group, have distinct gambling habits that could shape casinos in the future. Also, young adult casino visitors are more likely to participate in other forms of gambling—like casual betting with friends, playing poker, or gambling on the internet.

It’s the “House Edge”

Casino games have a built-in advantage for the operator. It’s known as the “House Edge.” The House Edge is the difference between the true odds and the odds—or probability—that the casino pays you when you win. This is known as the casino odds. The likelihood of rolling a particular number is known as the true odds.

The more combinations possible, the higher the odds. For example, you’re more likely to roll a seven than a two or a 12. However, since casinos take a portion of the winnings as a result of the House Edge, the winner gets true odds less the difference between true odds and the casino odds.

Depending on the game and player, the House Edge may be larger than what the above data suggests. As you can see from the chart above, there are different House Edges for blackjack. The stats are based on three types of games. The games are played with a particular basic strategy. In those games, the House Edge can be lessened by learning advanced strategy. Also, the House Edge can grow based on rule changes.

Most casino games have a House Edge between 0%–5%. Slot machines have a House Edge of 10%. Keno has a House Edge of 27%. Playing games with a smaller House Edge and learning correct strategy allows your dollars to last longer. This increases your chance of winning.

Estimating the loss

A player can estimate the loss before playing a particular game—if they know the House Edge. For example, a player knows the House Edge in blackjack is 0.6%. They can assume that for every $10 original wager they make, they would lose $0.06 on average. Most players aren’t going to know how much their average wager would be in games like blackjack—relative to the original wager. As a result, any statistic based on the average wager would be difficult to apply to real life scenarios.

Gambling addiction

With so many people gambling, the casino odds generate substantial profits for the casinos. Unfortunately, a need to keep playing the odds causes many people to develop a gambling addiction.

Major casino players like Las Vegas Sands (LVS), MGM Resorts (MGM), Caesar Entertainment (CZR), and Pinnacle Entertainment (PNK) attract millions of customers. This is one of the main reasons why casinos are such a profitable business. At times, there are big winners at the gaming tables. However, the only sure winner in a casino is the owner.

Exchange-traded funds (or ETFs) like the Consumer Discretionary Select Sector SPDR Fund (XLY) and the VanEck Vectors Gaming (or BJK) give investors exposure to the leisure industry.

To access our premium industry primers, company overviews and financial models, please email premium@marketrealist.com. Specify the industry or company ticker(s) you are interested in and a representative will get in touch with you.

The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning. Here’s a list of the top five most popular casino games.

Slots

Slots are machines that play a number of different games. Generally, a player inserts coins into the machine. Then they pull a handle or press a button. This causes the wheels to spin. When the wheels stop, the player gets paid based on the pattern of symbols.

Blackjack

Blackjack is a card game. It’s played between the house—also known as the dealer—and the player. The dealer deals out two cards to each player and keeps two cards. The dealer has one card face up and one down. The players take turns trying to get as close as they can to 21. The player calls “hit” to get a card and end their turn. A player can also call “double.” This doubles their bet. They can only get one card and their turn ends. If a player has two identically numbered cards, they can split.

Roulette

In roulette, the player places their chips on the table to wager them. The table has numbers 0-36 and 00. It has additional betting for even-odd, red-black, low 18-high 18, low/middle/high 12 and for the first/second/third columns. The dealer spins the wheel clockwise. Then, they roll a ball counter-clockwise. The ball lands in a numbered slot on the wheel. All bets that correspond with the number win.

Poker

Poker is a card game. It’s based on a five card hand. Hands are ranked from lowest to highest. The order of hands is high card, pair, two pair, three of a kind, straight, flush, full house, four of a kind, straight flush, and royal flush. The player with the best hand wins.

Craps

Craps is a dice game. The players make wagers on the outcome of the roll, or a series of rolls, of a pair of dice. If a seven or 11 turn up on the first roll of the dice, the shooter wins whatever they bet. If the shooter rolls two, three, or 12 on the first roll, they loose the money, but not the dice. When the person rolls a four, five, six, eight, nine, or ten that number becomes their “point.” The shooter keeps rolling until their “point” turns up again for a win or until the person throws a seven and loses the money and the dice.

Major casinos that offer the above mentioned games include Las Vegas Sands (LVS), Melco Crown Entertainment (MPEL), Caesar Entertainment (CZR), and Pinnacle Entertainment (PNK). Investors who would like to get exposure to the sector may invest in exchange-traded funds (or ETFs) like the VanEck Vectors Gaming (BJK). It tracks casino companies.

The evolution of casino industry

A banked game is a game of chance. The participating players don’t determine the prizes. A casino offers banked games. The commercial casino industry in the U.S. has changed over the last two decades. An increased emphasis has been placed on a wide range of entertainment and recreational activities.

The above chart shows different types of casinos in the U.S. It shows that land-based casinos are widespread. Racetrack casinos are popular in the eastern U.S. Tribal casinos are the Native American casinos. They’re the gambling operations on Indian reservations. Tribal casinos are widespread across the U.S. They aren’t always run by the tribe itself. The casinos can be run by an outside management company. Other commercial gaming venues include excursion—mobile—and dockside—permanently moored—riverboats and card rooms.

Until the recession started at then end of 2007, the U.S. casino industry was thought to be recession-proof—especially in Las Vegas. However, the industry experienced a steady decline in revenue during 2008 and 2009.

The casino industry’s expansion depends on voters. It also depends on hosting government jurisdictions. Governments enjoy the potential tax revenues that casinos offer. However, they have concerns about potential social costs and other problems that casinos may bring. The uncertainty has caused extreme volatility in the industry’s stock prices.

Key stocks and exchange-traded funds (or ETFs)

Key players in the casino industry include Las Vegas Sands (LVS), MGM Resorts (MGM), Caesar Entertainment (CZR), and Melco Crown Entertainment (MPEL). Exchange-traded funds (or ETFs) like the VanEck Vectors Gaming (or BJK) and the Consumer Discretionary Select Sector SPDR Fund (XLY) give investors exposure to the leisure industry.

To access our premium industry primers, company overviews and financial models, please email premium@marketrealist.com. Specify the industry or company ticker(s) you are interested in and a representative will get in touch with you.

Leverage’s positive impact on share price

The casino business model entails a significant amount of leverage use, in which the effects could be magnified to have a positive impact on equity. Land-based casinos are inherently highly leverage businesses that usually need to build properties, whether they’re tribal casinos in Oklahoma or multipurpose complexes in Macau. Casinos also have high fixed costs to pay for maintenance, labor, utilities, and licenses.

The above chart shows the share price performance of highly leveraged casino stocks since January 2013. It shows that in the past, Boyd Gaming’s (BYD) share price has doubled. Boyd Gaming has a net debt of over $4.1 billion and a market capitalization of about $1.2 billion.

MGM Resorts (MGM) had a 60% leverage in its capital structure but surged over 100%.

Most importantly, Caesars Entertainment’s (CZR) share price increased in excess of 350%, despite some $24 billion in debt. It’s also important to note that Caesars Entertainment’s leverage is greater than 100%, signifying that it has negative shareholders’ equity or shareholders’ deficit in its balance sheet.

However, Las Vegas Sands (LVS) and Melco Crown (MPEL)—with leverage of around 50% and 36%, respectively—have also seen a rise in their share prices.

Investors who’d like to get exposure to the industry can invest in exchange-traded funds (or ETFs) like VanEck Vectors Gaming (BJK) and Consumer Discretionary Select Sector SPDR Fund (XLY).

Unlocking hidden value

Major casino players have been looking into online gaming as a way to increase their market share and reach consumers who might not be willing to physically come to casinos.

In August 2009, Harrah’s Interactive Entertainment, now known as Caesars Entertainment (CZR), signed a long-term deal with Dragonfish, the business-to-business (or B2B) technology arm of the gaming site 888 Holdings, to power Harrah’s website.

From the above table, it can be seen that industry consolidation is an important step, as it usually profits the players by unlocking the hidden potential value. Each of these acquisitions in some way expand company offerings horizontally in the gaming space. The consolidation in gaming may actually benefit customers, provided that online gaming is approved nationwide.

The share prices for Bally Technologies (BYI), Scientific Games (SGMS), and Pinnacle Entertainment (PNK) surged immediately after announcing the deal.

Investors can get exposure to the leisure industry through exchange-traded funds (or ETFs) like VanEck Vectors Gaming (BJK) and Consumer Discretionary Select Sector SPDR Fund (XLY).

Online gaming growth rates have been driving market consolidation, as larger players in the gaming sector are looking to fill out their capabilities or to reach new markets. For example, in 2008, International Game Technology (IGT) purchased Million-2-1, a developer of mobile or cell phone gaming technology.

Million-2-1 also has a consumer-facing Internet games portal—Kerching—that offers online casino, poker, bingo, and SMS games and cell phone java slots games in legal territories.

In September 2009, Bwin purchased one of Italy’s largest online poker sites, Gioco Digitale.

So merger and acquisition activity is likely for traditional gaming companies that are reaching into virtual markets and for existing virtual leaders that are taking over smaller niche competitors.

A look into immediate future performance

Enterprise value (or EV) divided by earnings before interest, tax, depreciation, and amortization (or EBITDA) is a significant financial metric used in valuing comparable companies. This multiple’s capital structure is neutral, meaning it takes both the debt and shareholders perspective, unlike price divided by earnings (or PE) which takes only the shareholders perspective.

Generally, the lower the ratio, the more undervalued the company is believed to be. Since the casino operators are experiencing both organic and inorganic growth, EV divided by the trailing twelve months (or TTM) EBITDA would be less meaningful due to the failure to take into account the consolidated or expanded future performance of the casino operators.

So EV divided by the next twelve month (or NTM) EBITDA is a suitable measure for valuing the companies since it takes into account the immediate future performance of the company, incorporating the organic and inorganic growth factors into EBITDA.

The above chart shows that both Genting Malaysia and SJM Holdings are undervalued relative to its peers since both of these companies have significant net cash positions, which reduce the firms’ EV.

Companies like Caesars Entertainment (CZR), Boyd Gaming (BYD), MGM Resorts (MGM), and Penn National Gaming (PENN) have seen a rise in their share prices. A good way to get exposure to these companies is to invest in exchange-traded funds (or ETFs) like VanEck Vectors Gaming (BJK).

Buyer’s perspective

Buyers are more interested in ensuring their purchase price is reasonable against the next twelve months’ performance. It’s the future performance that would ultimately support the price paid by the buyer. In stable or mature industries, the last twelve months’ performance can serve as a good proxy for the next twelve months.

However, for companies in growth industries, like technology, or rapidly growing markets, the last twelve months would be less relevant. So buyers would focus on the reasonability of the NTM EV-to-EBITDA ratio and ensure that the multiple paid is within its tolerance level and industry benchmarks.

To know more about the casino gaming market performance, click here.

It’s more than just a casino

Does the traditional casino company that offers multiple services and products to its customers maximize its shareholder value? Or does a focused casino facility that specializes primarily in casinos maximize shareholder value? Or is it something in-between?

Rapid expansion of casino resorts, rather than casinos alone, suggests that diversifying amenities is profit-maximizing. Modern casinos offer a wide range of activities besides gambling, and adult visitors of all ages take advantage of these amenities.

The above chart shows that eating at a fine dining restaurant and seeing a show or concert are the most popular among all casino-goers, with 69% and 55% participating in such activities respectively. Young adult casino visitors are more likely to participate in all of the activities mentioned in the above chart.

Dominating non-casino activities

The market returns for a casino will be directly related to the casino’s ability to cross-promote its products and services to a diverse customer base. Moreover, the casino’s ability to tailor a variety of new products and services to its existing customers is expected to result in increased sales and shareholder value.

The casino industry has followed this path since non-casino revenues are now contributing significantly to the total revenues at many destination resort casinos, especially in large casino companies like Las Vegas Sands (LVS).

Attract and retain more customers

The above chart shows the diversified revenue streams of a casino operator. This diverse casino management strategy that moves away from casinos and moves towards other sources of revenue significantly impacts the value of casino companies.

With the expansion of casinos into new jurisdictions, competition has increased significantly. This competition gives rise to questioning which casino amenities are most important to offer casino patrons to drive profitability.

Other casino operators like Boyd Gaming (BYD), Melco Crown (MPEL), and Penn National Gaming (PENN) have to find a niche to place themselves in a unique position in the market due to this competition. So amenities other than the casino have started to have a significant impact on the overall performance of the firm.

Exchange-traded funds (or ETFs) like VanEck Vectors Gaming (BJK) and Consumer Discretionary Select Sector SPDR Fund (XLY) track companies in the leisure industry.

To learn more, see Must-know: A business overview of casino gaming.

The benefit of a fixed cost business model

Let’s say ABC is a casino operator with revenue and costs of $110 million and $100 million respectively, and its revenue increases by 10% in the following year, which causes modest increase in labor costs, maintenance expenditures, and fixed license fees.

ABC’s overall costs increase by say 5%, and instead of making $10 million in profits, it’s now making $16 million in profits ($121 million in revenue and $105 million in costs.) In other words, a 10% increase in revenue results in a 60% increase in profits. Assuming that the earnings before interest, tax, depreciation, and amortization (or EBITDA) multiple remains unchanged, this results in an increase to the share price.

The above chart shows the firm—which is generating $110 million in revenue, with $100 million in costs—is initially valued at say 10x EBITDA, or $100 million, with $70 million in debt and $30 million in equity. Now since revenue and costs rose by 10% and 5% respectively, owing to the fixed cost nature of the casino business, ABC’s EBITDA will rise to $16 million.

The total value of the firm at the same 10x EBITDA multiple will rise to $160 million. But the debt remains unchanged at $70 million. So equity will rise from $30 million to $90 million, or by 200%, as a result of the 10% increase in revenue.

This shows that when a company with high fixed costs touches breakeven, each additional customer becomes massively profitable. At this point, profit grows exponentially since each additional customer who comes in is at a minimal cost to the operator.

The pessimistic view

Let say ABC’s revenue drops by 5% to $104.5 million, but its costs decrease by say 2.5% to $97.5 million since state governments don’t lower license fees. ABC now experiences EBITDA of $7 million annually. Based on the same 10x EBITDA multiple, the firm is now valued at $70 million.

Remember that its debt is $70 million, which signifies that a 5% decline in revenue has entirely wiped its shareholder value, as shown by the above chart. This is the risk in high-debt casino stocks like MGM Resorts (MGM), Boyd Gaming (BYD), and Caesars Entertainment (CZR). This also explains why gambling stocks are more volatile than other stocks.

However, to avoid the risk of investing in such stocks individually, investors can invest in exchange-traded funds (or ETFs) like VanEck Vectors Gaming (BJK) and Consumer Discretionary Select Sector SPDR Fund (XLY) that give exposure to the industry.