Pinnacle Entertainment Inc

Latest Pinnacle Entertainment Inc News and Updates

Must-know: The most popular casino games

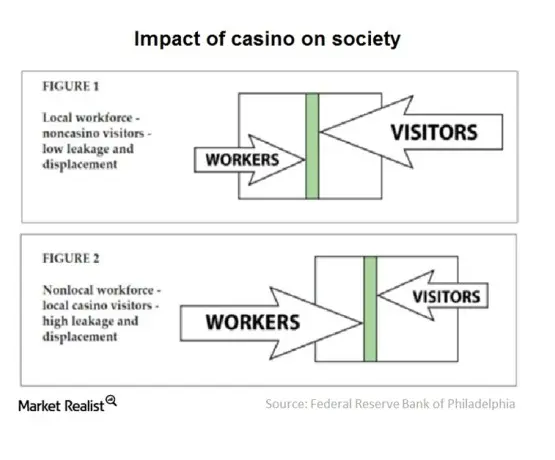

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

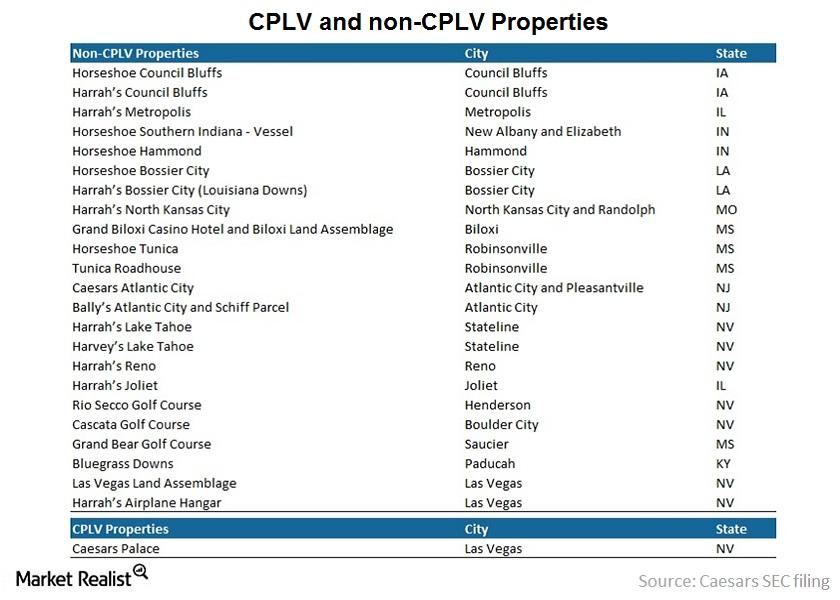

A Quick Guide To The Bifurcation Of Caesars’s Operating Leases

The initial term of each lease will be for 15 years with four five-year renewals. CZR will guarantee payments and performance of the OpCo’s obligations.

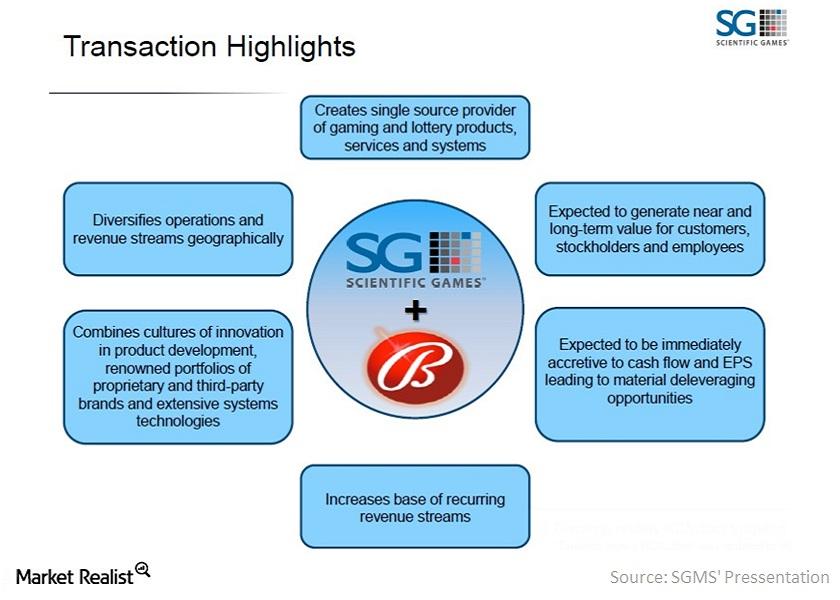

Scientific Games: Strategic Acquisition of Bally Technologies

In its merger agreement with Bally Technologies, Scientific Games agreed to acquire all outstanding Bally common stock for $83.3 cash per share.Consumer Must-know: Penn National Gaming’s performance metrics

Performance metric Penn National Gaming, Inc. (PENN) defines adjusted EBITDA as earnings before interest, taxes, stock compensation, debt-extinguishment charges, impairment charges, insurance recoveries and deductible charges, depreciation and amortization, gain or loss on disposal of assets, and other income or expenses. Adjusted EBITDAR is adjusted EBITDA excluding rent expenses such as those associated with PENN’s […]

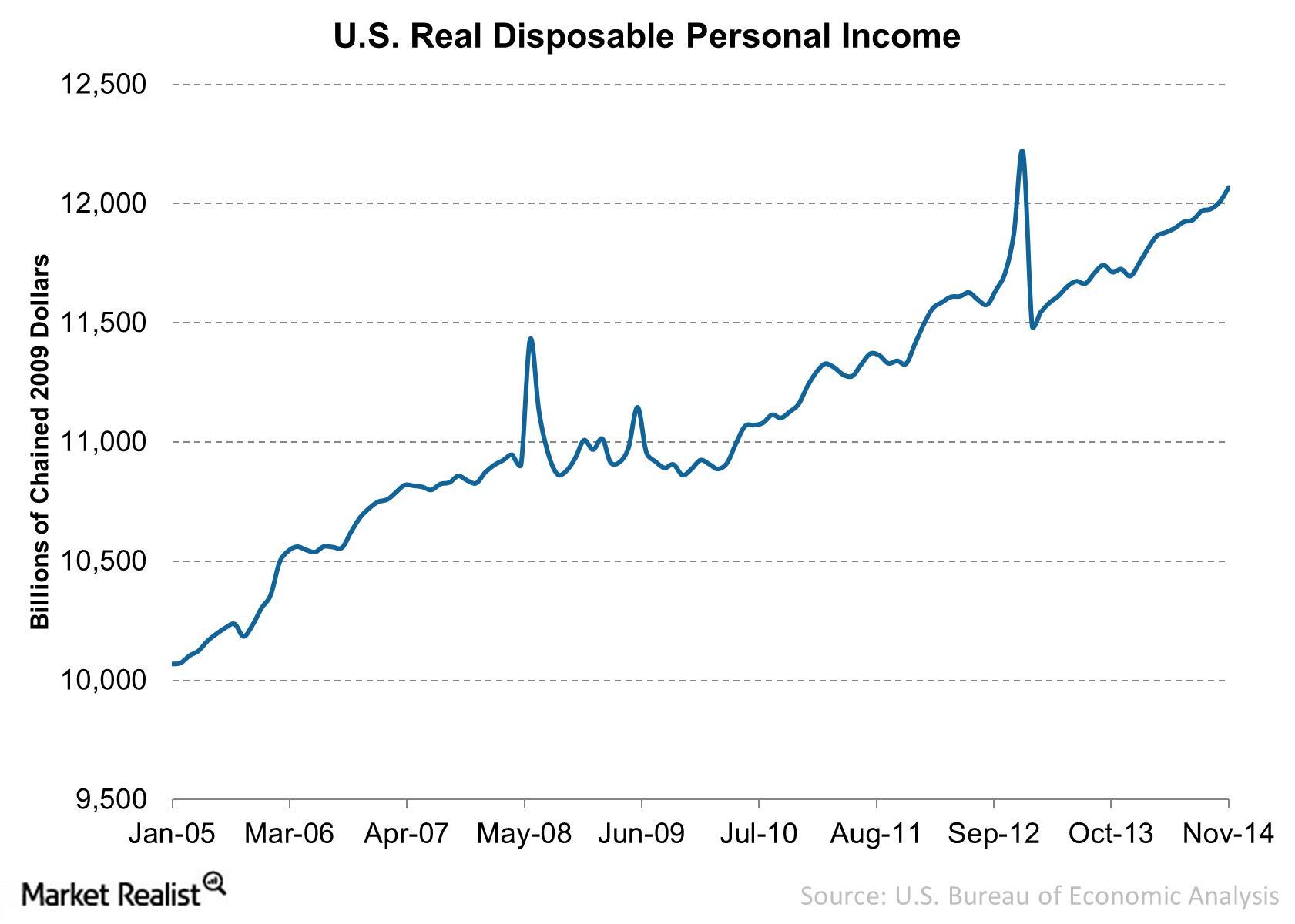

Why Casinos Rely On Disposable Income

On a year-over-year basis, real disposable income increased 2.9%. More disposable income boosts consumer buying power.

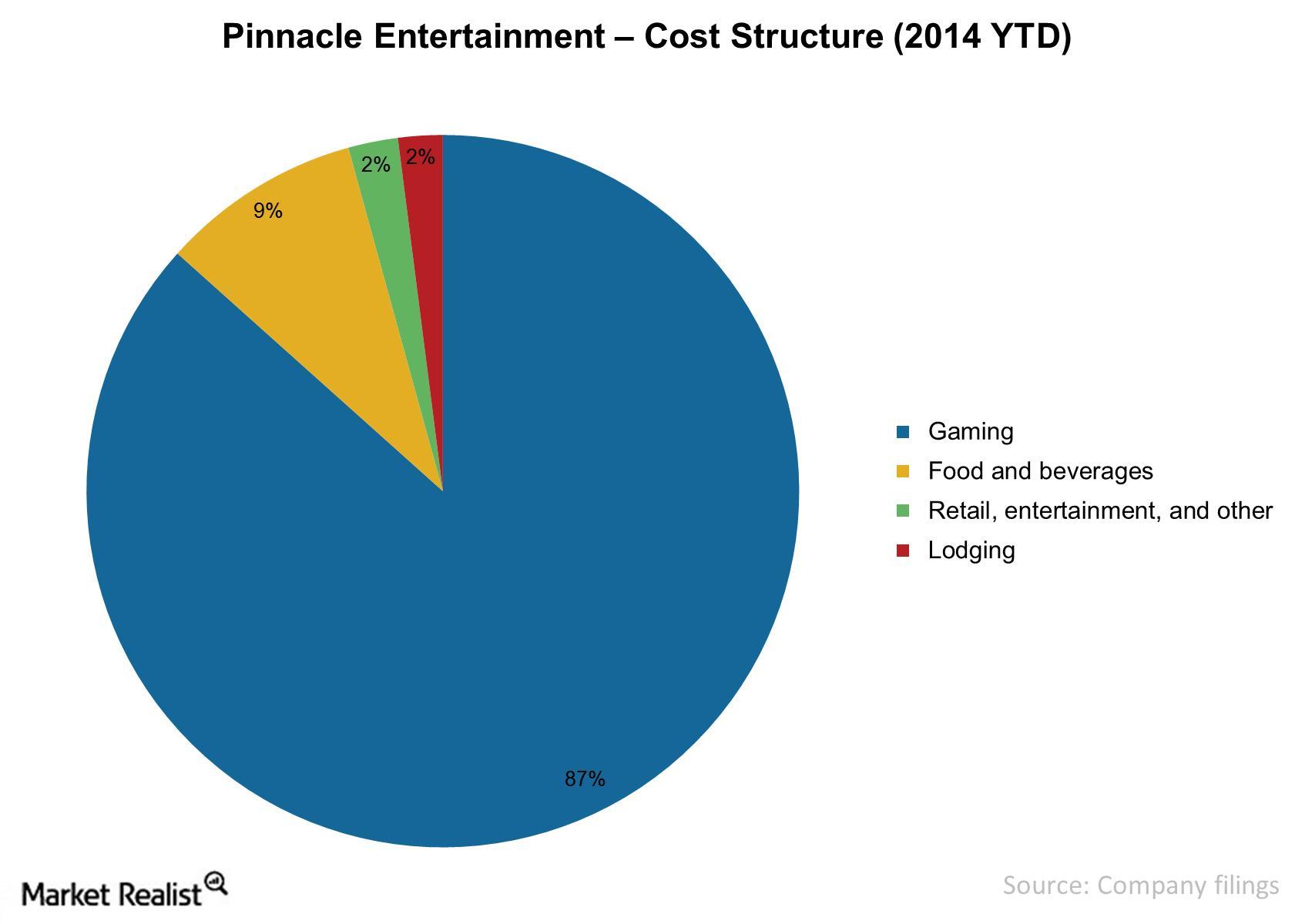

Pinnacle Entertainment’s cost structure

Pinnacle Entertainment (PNK) incurs direct costs in gaming, food and beverage, lodging, retail, entertainment, and other areas.Consumer Why the commercial gaming market is increasing for casinos

Casino gaming is the largest part of the commercial gaming market. It continues to grow in popularity. There has been a surge in demand for casino games. As a result, new casino destinations have been created. Existing casinos have also been expanded.