Scientific Games Corp

Latest Scientific Games Corp News and Updates

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

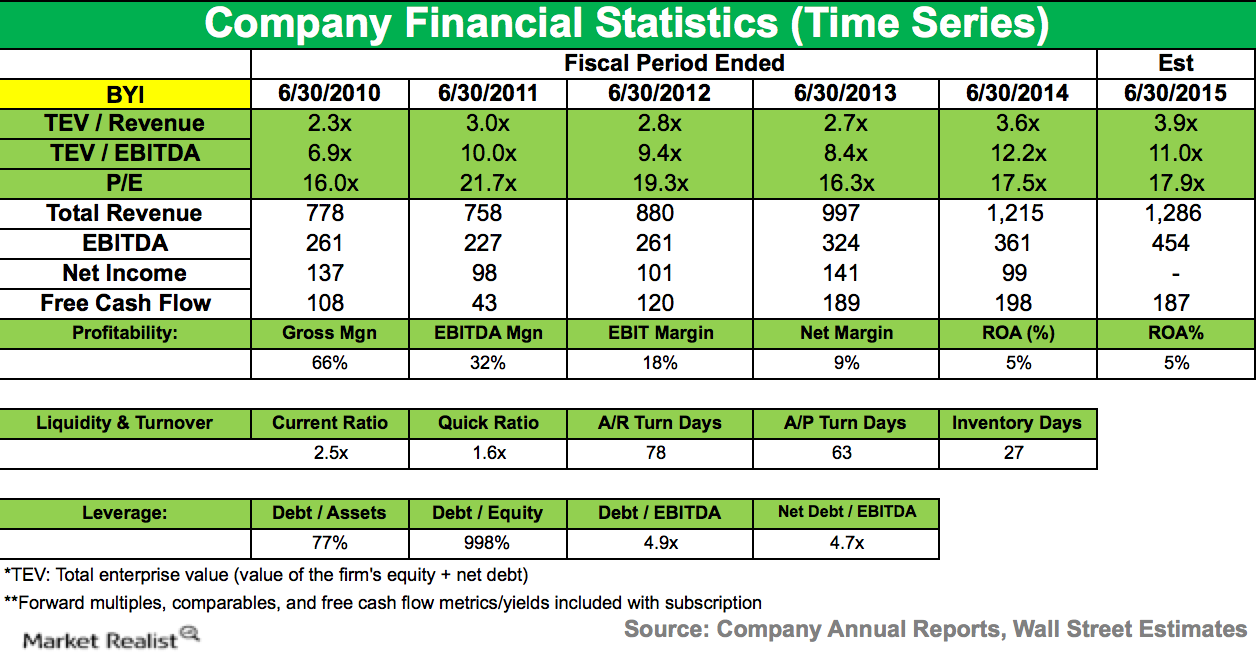

AQR Capital initiated position in Bally Technologies Inc.

AQR Capital initiated a position in Bally Technologies during the third quarter of 2014 that accounts for 0.22% of the fund’s 3Q14 portfolio.

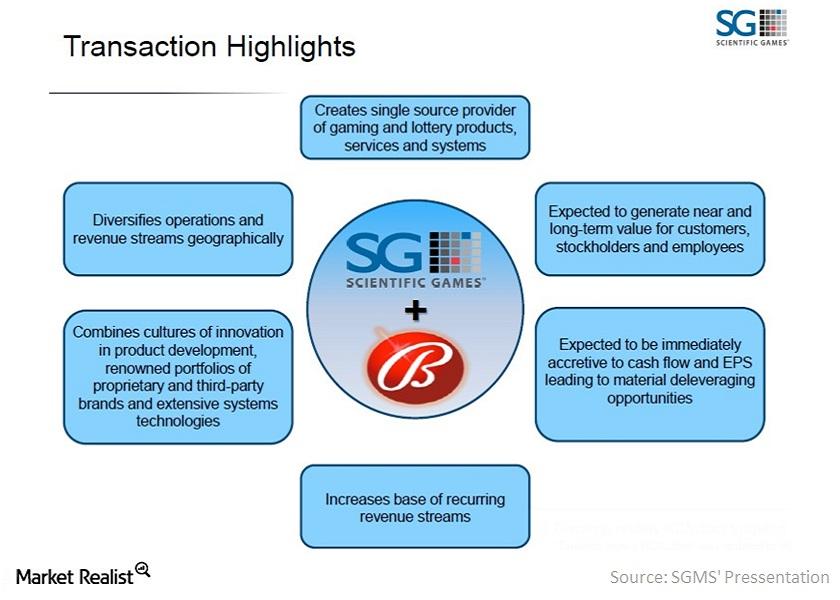

Scientific Games: Strategic Acquisition of Bally Technologies

In its merger agreement with Bally Technologies, Scientific Games agreed to acquire all outstanding Bally common stock for $83.3 cash per share.

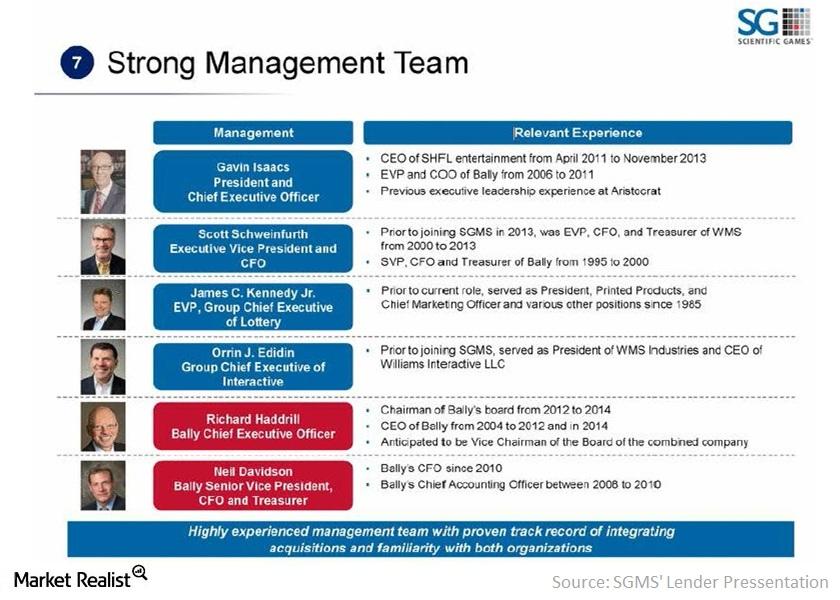

Consolidated Scientific Games: A Stronger Management Team

The executive management team of SGMS includes President and CEO Gavin Isaacs and Executive Vice President and CFO Scott Schweinfurth.