An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

Aug. 29 2014, Published 1:51 p.m. ET

Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

Chesapeake’s business segments

CHK’s exploration and production business is organized into two major geographic operating divisions:

- The Southern division, which includes the Eagle Ford Shale, Mid-Continent, and Haynesville Shale

- The Northern division, which includes the Utica Shale, Marcellus Shale, and Powder River Basin

Key financials

CHK has a market capitalization of $17.7 billion and an enterprise value of $32.9 billion as of August 25. The majority of the company’s operations focus on the exploration and production of unconventional natural gas and natural gas liquids (or NGLs).

Natural gas focus

While it focuses on increasing its liquids production, Chesapeake remains a “gas-weighted” company. Its gas production, on an oil equivalent basis, currently exceeds its liquids production.

In 1Q 2014, CHK’s total production was 16% oil, 12% natural gas liquids, and 72% natural gas.

Key ETFs

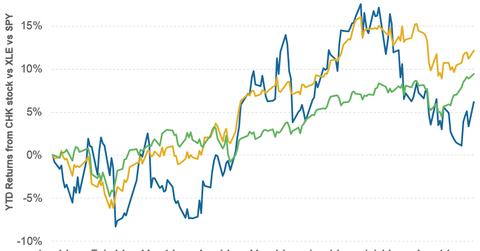

CHK is a component of several energy ETFs. These include the Energy Select Sector SPDR (XLE), the Vanguard Energy ETF (VDE), the iShares US Energy ETF (IYE), and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Looking deeper

The following parts of this series take a deeper look at CHK’s operations.