Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.

Dec. 8 2014, Updated 8:00 a.m. ET

The mechanics

The Reserve Bank of India (or RBI) is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year. Apart from these announcements, the RBI used to review its stance once every quarter. After several changes, it reviews its stance once in two months. However, it can make changes to policy between the reviews if necessary.

The RBI releases a statement after the board has internal discussions. The governor is the main authority for making decisions. The other board members assume advisory roles. The governor conducts a customary meeting with the heads of major commercial banks and the country’s finance minister to get their views before making the announcements.

Although the RBI doesn’t have a monetary policy committee (or MPC) structure—like the Bank of England—it intends to head in that direction.

Objectives

The RBI has three objectives when it formulates monetary policy:

- maintaining price stability

- ensuring adequate flow of credit to sustain the growth momentum

- securing financial stability

These objectives were stated explicitly in The Reserve Bank of India Act, 1934. The objectives are different from central banks in the US, the United Kingdom, and Japan. The Federal Reserve is responsible for two goals—to promote “maximum” sustainable output and employment and to promote “stable” prices. The Bank of England and the Bank of Japan have one objective—maintaining “price stability.”

How has the RBI fared?

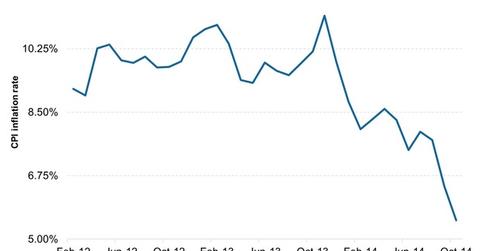

With inflation looming large on monetary policy decisions, the RBI struggled to attain its price stability objective. It’s important to note that monetary policy can’t work alone to guard against inflation. It has to be supplemented by fiscal policy in order to claim victory over the common enemy—inflation.

In its struggle against inflation, the RBI claimed that there was a lack of support from a fiscal standpoint. This would have solved the structural issues in the economy. It would have helped tame inflation. To understand more about India’s inflation indicators, read “India’s different inflation measures—WPI versus CPI.”

In the past three months, inflation decreased significantly. Although it’s too early to celebrate, it appears that the central bank’s policies are creating the desired results.

Indian exchange-traded funds (or ETFs) that are impacted by monetary policy announcements include the EGShares India Infrastructure ETF (INXX), the WisdomTree India Earnings Fund (EPI), the PowerShares India Portfolio (PIN), the iShares S&P India Nifty 50 Index Fund (INDY), and the VanEck Vectors India Small-Cap Index ETF (SCIF).

In the next part of this series, we’ll discuss whether Indian investments are affected by the Federal Reserve’s policy decisions.