An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

May 7 2014, Published 3:23 p.m. ET

Access Midstream Partners

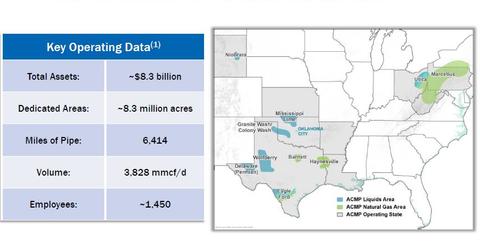

On April 29, 2014, Access Midstream Partners, L.P. presented its earnings for the first quarter of 2014. Access Midstream Partners, L.P. (ACMP) is a master limited partnership operating in the midstream energy space. ACMP owns, operates, develops and acquires natural gas, natural gas liquids (or NGLs), and oil gathering systems and other midstream energy assets.

The company’s operations are focused on the Barnett, Eagle Ford, Haynesville, Marcellus, Niobrara, Utica shales, and the Mid-Continent region of the U.S. As of March 31, 2014, the company operates 6,414 miles of pipelines and had an average throughput of 3.8 billion cubic feet per day of gas. GIP and Williams Companies, Inc. (WMB) through their joint ownership of Access Midstream Ventures, L.L.C., own the general partner interest in ACMP. As of February 19, 2014, GIP and Williams Partners own 54.9% of ACMP’s limited partner interests.

The company’s operation is distributed in seven operating regions. The Barnett Shale Region located in Texas at the Tarrant, Johnson and Dallas counties has assets consisting of 28 interconnected gathering systems and 859 miles of pipeline. Average throughput on the Barnett Shale gathering systems for the year ended December 31, 2013, was 1.045 billion cubic feet per day. The pipeline system primarily serves the greater Dallas/Fort Worth metropolitan area and south, east, and west Texas markets.

The Eagle Ford Shale Region located in the Dimmit, La Salle, Frio, Zavala, McMullen, and Webb counties in Texas and consists of 11 gathering systems and 870 miles of pipeline. For 2013, average throughput for these assets was 0.26 billion cubic feet per day. The pipeline system’s delivery points include plants and products of Enterprise Products (EPD), Camino Real, West Texas Gas, Regency Gas Service, Eagle Ford Gathering, and Enerfin.

ACMP’s Haynesville Shale Region is primarily located in Caddo and DeSoto Parishes, Louisiana, in one of the core areas of the Haynesville Shale and consists of 28 interconnected gathering systems and 274 miles of pipeline. By the end of 2013, it had an average throughput of 0.302 billion cubic feet per day. The gathering system is connected to the downstream transportation pipelines of Enable Energy Gas Transmission, ETC Tiger Pipeline and Texas Gas Transmission Pipeline.

In the Marcellus Shale Region, ACMP owns and operates ten natural gas gathering systems that consist of approximately 823 miles of gathering pipeline. This segment’s majority area of operation consists of northern Pennsylvania, southwestern Pennsylvania, and the northwestern panhandle of West Virginia. Average gross throughput for the Marcellus Shale assets was 2.212 billion cubic feet per day. The delivery points of the system consist of plants, storages, and pipelines of Williams Partners, L.P. (WPZ), Central New York Oil & Gas, Columbia Gas Transmission, MarkWest Energy Partners, L.P. (MWE), NiSource Midstream, PVR, and Tennessee Gas Pipeline.

In the Niobrara Shale Region, ACMP has two interconnected natural gas gathering systems with 132 miles of pipeline. Average throughput in the Niobrara Shale region for the year ended December 31, 2013, was 0.015 billion cubic feet per day. Its delivery points are Tallgrass/Douglas Pipeline and Anadarko MIGC sale point.

The company’s Utica Shale Region operation has a wet gas gathering system, four lean gas gathering systems, and a joint venture that owns two processing trains. The region’s operations are primarily located in northeast Ohio and consist of 265 miles of pipeline with average throughput of 0.267 billion cubic feet per day. The major delivery points are Dominion Transmission, Inc. and Utica East Ohio Midstream.

The Mid-Continent Region consists of Anadarko Basin and Northwest Oklahoma, Permian Basin, and other Mid-Continent regions. The Anadarko Basin and Northwest Oklahoma region gathering systems had an average throughput of 0.431 billion cubic feet per day. The operation primarily focuses on servicing Chesapeake’s (CHK) production. The pipelines of this region typically contain significant amount of NGLs. In the Permian Basin in west Texas, ACMP’s assets consist of approximately 486 miles of pipeline with average throughput of 0.082 billion cubic feet per day.

As of May 1, 2014, Access Midstream Partners (ACMP) had a market capitalization of $11.24 billion and enterprise value of $14.38 billion. For the last 12 months ending March 31, 2014, ACMP recorded revenues of $1.11 billion and EBITDA of $924.3 million. Distribution per unit declared on April 28, 2014, was $0.575 per common unit, or $2.30 annualized. This amounts to a distribution yield of 3.9% for a stock price of $59.43 as of May 1, 2014. The current yield of ACMP is below the AMLP ETF yield of ~6%. However, ACMP expects to grow EBITDA ~20% year-over-year through 2014 and 2015.

Access Midstream Partners, L.P. (ACMP) is a master limited partnership operating in the midstream energy space. Williams Companies (WMB) and Global Infrastructure Partners jointly own ACMP’s general partnership. The majority of ACMP’s revenues come from Chesapeake Energy (CHK). ACMP is part of the Alerian MLP ETF (AMLP) and Chesapeake is part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

For a detailed discussion on EBITDA growth, please read the following parts of this series.