Access Midstream Partners LP

Latest Access Midstream Partners LP News and Updates

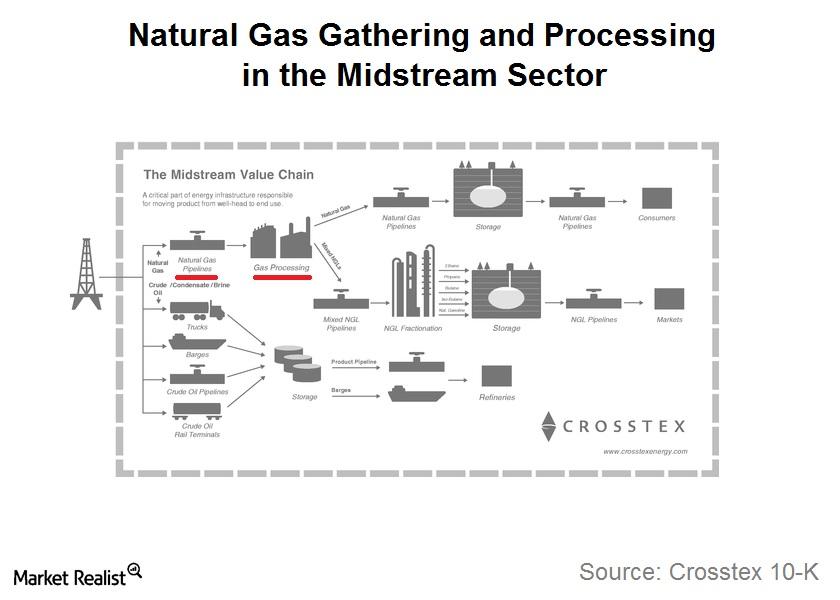

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

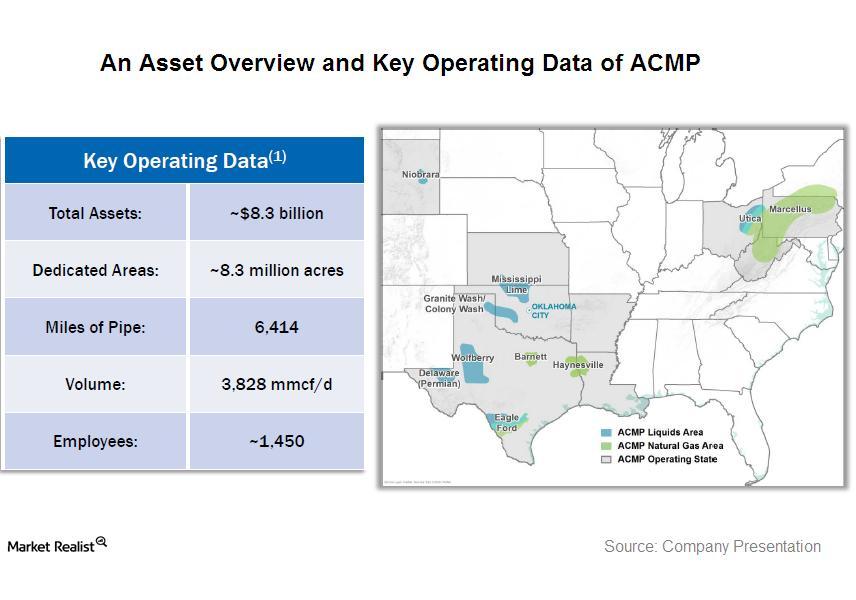

An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

How MLPs profit from natural gas gathering and processing

Natural gas gathering and processing are a significant part of the operations of many midstream master limited partnerships.