Japan’s trade deficit with China: Worse for GM than the recall

This article considers the impact of Japan’s trade dynamics on Japanese automakers like Toyota (TM) versus General Motors (GM) from a macroeconomic perspective.

Dec. 4 2020, Updated 10:53 a.m. ET

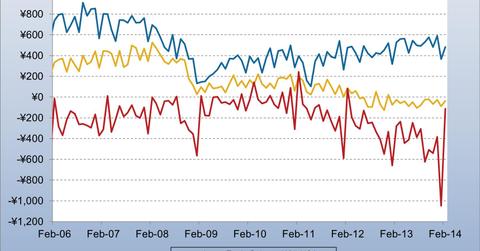

A growing trade deficit pressures Japanese yen

The below graph reflects the source of Japan’s trade deficit—China. The prior graph reflected Japan’s large trade deficit related to oil imports, while the below graph reflects the trade deficit related to Chinese imports. Japan continues to grow its trade deficit with China, while Japan’s pre-2008 crisis trade surplus with the European Union has essentially disappeared. Japan’s trade surplus with the U.S. has simply declined to half of what it was in 2007. This article considers the impact of Japan’s trade dynamics on Japanese automakers like Toyota (TM) versus General Motors (GM) from a macroeconomic perspective.

Japan’s auto exports

Japan’s manufacturing exports reflect that autos comprise 16.4% of shipments, while electrical machinery, the next largest sector, comprises 15.5% of shipments. The Japanese auto sector is approximately $400 billion per annum of Japan’s $5 trillion GDP. Clearly, Japan’s auto sector, to include auto exports, is a key driver for Japan’s overall economic growth, and what is good for Toyota is good for Japan.

Toyota’s sales and profits strengthen on a weak yen

Not only is Japan’s trade deficit pressing the yen lower, but the Bank of Japan’s unprecedented monetary stimulus is reinforcing the yen weakness. For Toyota, every 1-yen drop in the exchange rate against the U.S. dollar translates in to approximately 35 billion yen, or roughly $350 million in operating profit. For the nine months ended December 31, Toyota’s net income increased from 648 billion yen to 1.52 trillion yen—roughly $15 billion—pushing $20 billion annualized. Should the yen weaken 20% in the next year on the back of the trade deficit and monetary expansion, that may add as much as $7 billion to Japan’s earnings over a year.

In other words, if the yen averages 120 versus the U.S. dollar for the next 12 months, Toyota can see fiscal 2014 earnings (through March 31, 2015) of around $25 billion. In comparison, GM’s net income in 2013 was $3.8 billion. Clearly, the foreign exchange rate is extremely important to Toyota’s profits and its ability to compete with GM. In 2013, Toyota sold 9.98 million vehicles versus GM’s 9.71 million. Toyota predicts sales in 2014 to hit 10.32 million vehicles—the first over-10 million sales mark. This earnings differential reflects Toyota’s superior profitability over GM, which is greatly enhanced by a weaker yen.

The yen should weaken

The above graph suggests that Japan’s ongoing trade deficit will pressure the Japanese yen. As the Yen weakens against the U.S. dollar and euro, Japanese domestic automakers benefit from the decline in their production base costs. This trend should support Japan’s automakers in the future, as they may gain increased pricing power against their U.S. competitors, such as GM or Ford. Overall, these trends paint a positive outlook for Japanese export growth in the long run, although in the short run, the immediate rise in the cost of imports will likely have a chilling impact on growth and consumption. In the near term, investors may shy away from exporters on the back of weak domestic economic data. However, in the long term, export growth should provide the foundation for improved corporate profitability, which is already excellent by historical standards.

Japan’s equity outlook

As 2014 progresses, investors may see a continued outperformance of Wisdom Tree Japan Hedged (DXJ) and the iShares MSCI Japan ETF (EWJ) versus China’s iShares FTSE China 25 Index Fund (FXI) and Korea’s iShares MSCI South Korea Capped Index Fund (EWY). For further clarification as to why DXJ may outperform both EWJ and the other Asian equity indices, read Why Japanese ETF’s outperform Chinese and Korean ETF’s on Abenomics. Plus, as Japan pursues unprecedented monetary expansion, and the U.S. Fed tapers its bond purchases, Japanese equities can also outperform broad U.S. equity indices, as reflected in the State Street Global Advisors S&P 500 SPDR (SPY), State Street Global Advisors Dow Jones Index SPDR (DIA), and Blackrock iShares S&P 500 Index (IVV).

For more on how the U.S. Fed’s recent announcements could impact global equities, read Will the Fed take a bite out of Apple?

To see how Japan’s investment recovery could bolster the domestic manufacturing base for companies like Toyota, please see the next article.