Why Toll Brothers differs from other builders: An investor’s guide

Toll Brothers caters to move-up, empty-nest, active-adult, age-qualified, and second-home buyers in the United States. It currently operates in 19 states.

Feb. 26 2014, Published 12:03 p.m. ET

Toll Brothers focuses on the luxury end of the homebuilding market

Toll Brothers (TOL) designs, builds, and markets luxury attached and detached homes in upscale residential communities. It also builds and converts existing apartment buildings into high-, mid-, and low-rise luxury homes and is developing a luxury condominium and for-rent high-rise apartment complex. Toll Brothers caters to move-up, empty-nest, active-adult, age-qualified, and second-home buyers in the United States. It currently operates in 19 states.

Toll Brothers is generally located around large cities and the suburbs and has a largely coastal presence. Toll develops golf courses and country clubs in conjunction with its master communities. Toll tends to partner with unrelated parties in some luxury condo projects, as well as luxury hotels, and some planned communities.

Toll has also created two trusts that invest in commercial real estate ventures, and they also operate a real estate asset manager (Gibraltar), which invests in distressed real estate opportunities.

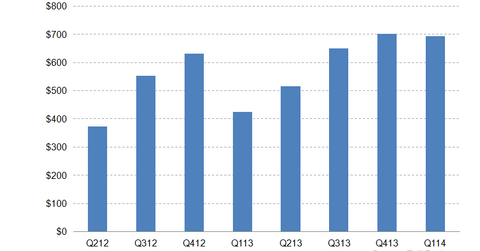

Toll Brothers’ average selling prices are much higher than the other builders like Lennar (LEN), D.R. Horton (DHI), or Pulte (PHM). Toll’s latest average selling price is north of $700,000. This means its customer base is very different than most other builders. This customer has largely shrugged off the real estate bust, as the high end of the market has held up better than the lower end. Second, quantitative easing has increased asset prices, and those who benefit most from asset price inflation are the rich.

That said, the typical Toll customer hasn’t been immune to the slowdown. In particular, they may be worried about the path of the economy, or be trapped in homes they can’t sell. For the most part, however, Toll customers remained employed during the downturn and are in a better position to buy than customers of the entry-level builders like Pulte.

Toll recently acquired West Coast–based builder Shapell. This deal will increase its exposure to the red-hot Los Angeles and San Francisco markets. We’re starting to see more M&A (mergers and acquisitions) activity in the homebuilding space, as builders find it easier to buy lots through a merger than to find attractive land purchase activities on a one-off basis. Second, the easy financing available these days make these sorts of purchases attractive. This financing is generally available to the big builders, so scale matters.

To learn more about investing in TOL, see the Market Realist series Why Toll Brothers’ Q4 and FY13 results predict growth.