Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

May 19 2015, Published 2:03 p.m. ET

Inflation, duration, and TIPS

Most U.S. Treasury securities have two sources of return: coupon and price. Coupon payments are paid semi-annually. The price of the security fluctuates with changes in market yields. TIPS securities have three sources of return. Like other Treasuries, they pay a coupon and their price will be impacted by changes in yields. Additionally, a holder of a TIPS bond is impacted by inflation; if inflation rises the holder could receive both higher income and a higher principal payment at maturity (although it should be noted that TIPS typically have lower yields than conventional fixed rate bonds).

Market Realist – Comparing Treasury Inflation-Protected Securities and Treasuries.

TIPS (TIP) provide investors a hedge against inflation, like gold (IAU) and other commodities. However, this protection comes at a cost. This comes in the form of lower coupons. The yield on TIPS will always be lower than that of Treasuries (TLT) (SHY) with the same maturities unless inflation turns negative. The difference in the yields of the two indicate expected inflation.

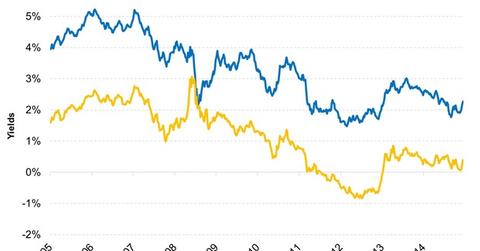

The graph above compares the yields of the ten-year US Treasuries (IEF) and those of the ten-year TIPS over the last decade. The great recession and then the bond-buying program led the Treasury yields to dip, which led to the corresponding dip in the yield for TIPS.

Currently, the yield for the ten-year TIPS is 0.4%, while the ten-year Treasuries are trading close to 2.3%. Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

As an asset class, equities (SPY) (QQQ) are not a particularly good hedge against inflation. TIPS provide you with an excellent option to hedge against inflation if you don’t want to venture into commodities.