How the US Economy Performed in 2017

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

Dec. 22 2017, Published 1:39 p.m. ET

The year in review

This year has been a year to watch what the US economy is doing. With the transition to the Trump administration, hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher. Economic performance edged higher due to an uptick in demand in the domestic as well as international markets, making 2017 one of the best years in quite some time.

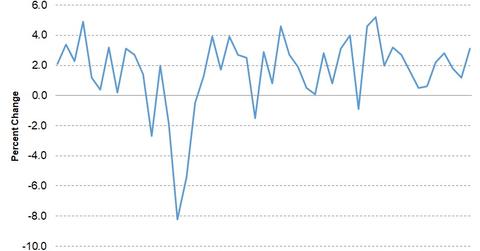

US GDP growth at 3-year high

In the third quarter of 2017, the US GDP rose 3.3%, the highest in three years. Key contributors to higher economic performance were increases in fixed investments for equipment, inventories, and government investments. In that same period, the unemployment rate fell to 4.1%, the lowest since 2001, aided by increased employment in manufacturing (XLI), services, and healthcare (IYH). US inflation (TIP), which has been below the Fed’s 2% target, was the key disappointment in 2017.

Going forward, we’ll have to see what the recently passed tax reform bill will do to economic performance in the short term and the long term.

Series overview

In this series, we’ll be looking at various economic indicators in 2017 and their impact on the US economy. We’ll also look at the Fed’s monetary policy decisions and discuss the performances of the industries (IYJ) that are influenced by changes in these economic indicators. In the next part of this series, we’ll look at what the Fed has accomplished in 2017.