University of Michigan Consumer Confidence Index dips in August

The Thomson Reuters/University of Michigan Consumer Confidence Index is a leading indicator for the U.S. economy The Thomson Reuters/University of Michigan Consumer Confidence Index is an important indicator of the consumer’s perception of the U.S. economy. Similar to other consumer confidence measures, it asks consumers about their views on the current economic conditions and their […]

Nov. 20 2020, Updated 12:55 p.m. ET

The Thomson Reuters/University of Michigan Consumer Confidence Index is a leading indicator for the U.S. economy

The Thomson Reuters/University of Michigan Consumer Confidence Index is an important indicator of the consumer’s perception of the U.S. economy. Similar to other consumer confidence measures, it asks consumers about their views on the current economic conditions and their expectations for six months out. It’s one of the oldest consumer surveys, originally started in 1964.

Consumption is the major driver of the U.S. economy and it accounts for 70% of GDP. Consumption has been relatively subdued since the recession began, as Americans have boosted their savings rate and spent only on essentials. The real estate bubble drove consumption in the mid-’00s as people took out cash refinances and spent the extracted home equity. This increased the cost basis for many people’s homes and left them vulnerable when house prices collapsed. As a result, they’ve focused more on paying down debt than spending.

Highlights from the report

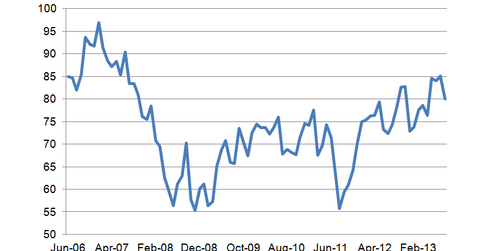

The Consumer Sentiment Index fell to 80 in August, down from 85.1 in July. (Consumer confidence in 1964 = 100.) The Bloomberg survey consensus was 85.2. The Current Conditions Index fell from 98.6 to 91, and the Expectations Index dropped to 72.9 from 76.5 last month. Given that an index value of 90 is more or less the average over the past 50 years, consumer confidence is still on the weak side. But the index can vary widely. In January of 2000, it was 112, and in November of 2008, it bottomed at 55.3. To put the drop in perspective, last month’s number was a six-year high, so things are still pretty positive.

One theory that’s been thrown out is that consumers are starting to pick up on the improvement in the real estate market and that’s driving consumer confidence. As we’ve seen from the real estate indices, unless you live in San Francisco, Phoenix, Las Vegas, or a few other places, you haven’t really been experiencing a major increase in home prices. It may be that the headline numbers are enough to make people feel better even if prices aren’t rising that dramatically where they live.

Implications for homebuilders

KB Home CEO Jeffrey Metzger said on the company’s earnings conference call that consumer confidence was more important to its business than the level of interest rates. Buying a new home is such a commitment that buyers require certainty about their job prospects and the economy before they entertain this purchase.

KB and Lennar both noted that the first-time homebuyer was returning to the market and that household formation appeared to be increasing again. There’s a lot of pent-up demand from young adults, and once that unleashes, it should drive business for homebuilders at lower price points like PulteGroup (PHM), Lennar (LEN), KB Home (KBH), Ryland (RYL), and Meritage (MTH).