Weekly tanker digest: Have fundamentals changed? (Part 4)

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]

Dec. 4 2020, Updated 10:43 a.m. ET

Continued from Part 3

The importance of capacity

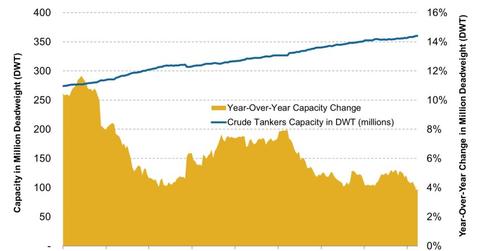

Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day rates, which will negatively affect bottom-line earnings, free cash flows, and share prices for tanker companies.

While ship orders (see Part 2 and Part 3) reflect managers’ expectations of future demand and supply, investors also look at capacity growth to get a sense of how fast current supply is growing and whether demand will meet it, instead of simply relying on managers, who can get caught up in the day-to-day operation without seeing the bigger picture.

Elevated supply growth

For the week ending July 19, tanker capacity measured in deadweight (the weight that a ship can safely carry across the ocean) grew 3.90% year-over-year—higher than last week’s 3.83% but below 4.15% the week before that—based on data provided by IHS Global Limited. This is one of the lowest increases the industry has seen in at least five years. Capacity growth hit as high as 11% and 8% in 2009 and 2011, as managers got too caught up with an increased flow of business before the financial crisis. As managers expected oil trade to continue to grow rapidly, they placed large orders of new ships, which eventually led to oversupply.

Year-over-year capacity growth fell from peak levels because managers refrained from purchasing more new ships when they realized how many they had ordered. While this is a positive development, supply growth remains above demand growth. According to RS-Platou, an international ship and offshore brokers and investment bank, the oil trade fell 2.6% during the first four months of this year compared to last year, which was far lower than the supply growth of 4.76% over the same period. Although Platts reported an 11.7% year-over-year increase in China’s June apparent demand for oil on July 24, year-over-year import growth is unlikely to show significant improvements due to last year’s stockpiling activity.

Effect on tankers

An elevated supply growth will continue to pressure tankers such as Tsakos Energy Navigation Ltd. (TNP), Ship Finance International Ltd. (SFL), Nordic American Tankers Ltd. (NAT), and Teekay Tankers Ltd. (TNK) earlier this year, even though the broad market rose higher. The Guggenheim Shipping ETF (SEA) has fared better, as several of its holdings are listed in Japan, which has performed well lately. Since construction activity is near a five-year record low (see Part 3), capacity growth should fall further over the next few months. But unless growth falls below demand growth, tanker rates are unlikely to rise.

Learn more about indicators that reflect tanker fundamentals

Continue on to U.S. rig count (Part 5) or go back to see the List of indicators (Part 1).