OECD’s Crude Oil Inventories: Trump Card for Crude Oil Bulls?

The EIA estimates that global crude oil inventories could rise in 2018 and 2019, which is bearish for oil prices.

Jan. 18 2018, Published 8:53 a.m. ET

OECD’s crude oil inventories

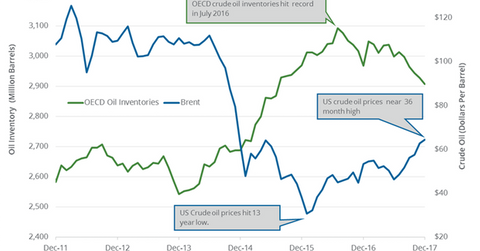

According to the EIA (U.S. Energy Information Administration), OECD’s (Organisation for Economic Cooperation and Development) oil inventories declined by 20.6 MMbbls (million barrels) or 0.7% to 2,907.6 MMbbls in December 2017—compared to the previous month. OECD’s crude oil inventories also declined by 60 MMbbls or 2% from a year ago.

The inventories have fallen by 141.5 MMbbls or 4.6% since January 2017 due to ongoing production cuts and improving global oil demand. The drop in OECD’s oil inventories has a positive impact on oil (SCO) (UWT) prices. Brent crude (BNO) (USO) oil prices rose ~18% between January 2017 and December 2017.

OECD crude oil inventories peaked

OECD’s oil inventories hit 3,093 MMbbls in July 2016—the highest level ever. Brent oil prices averaged ~$45 per barrel in July 2016. Prices recovered from a 13-year low hit in early 2016. In contrast, OECD’s oil inventories hit 2,543 MMbbls in December 2013—the lowest level since 2004. Brent oil prices averaged ~$111 per barrel in December 2013.

Estimates

OECD’s oil inventories averaged 2,968 MMbbls and 2,908 MMbbls in 2016 and 2017. The decline in OECD’s crude oil inventories in 2017 was bullish for oil (USL) (SCO) prices. It also benefits oil producers (FENY) (FXN) like BP (BP), Chevron (CVX), Rosneft, Shell (RDS.A), Sanchez Energy (SN), and Approach Resources (AREX).

The EIA estimates that OECD’s oil inventories will average 2,964 MMbbls and 3,049 MMbbls in 2018 and 2019.

Impact

OECD’s crude oil inventories were near a 29-month low. They have fallen 6% since the record in July 2016. Production cuts could help draw down global crude oil inventories in 2018, which is bullish for oil (UWT) (SCO) prices. However, the EIA estimates that global crude oil inventories could rise in 2018 and 2019, which is bearish for oil prices.

Next, we’ll discuss how the global supply outage impacts oil prices.