Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Dec. 5 2017, Updated 9:02 a.m. ET

US dollar managed marginal gains last week

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%. Investors were reacting to every news report about tax reform and the possibility of a political crisis in the US after NSA advisor Michael Flynn admitted to lying to the FBI about contact with the Russians. The US Dollar Index closed for the week ending December 1 at 92.84, but early trades on Monday indicated further gains as traders reacted to the Senate’s approval of the tax reform bill.

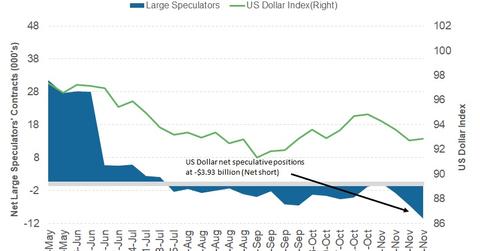

Speculators added bearish bets on the US dollar

As per the latest commitment of traders (or COT) report, released on December 1 by the Chicago Futures Trading Commission (or CFTC), large speculators and traders increased their bearish bets on the US dollar through Tuesday, November 28.

As per Reuters calculations, the net US dollar (USDU) net short positions increased to -$3.9 billion as compared to -$3.2 billion in the previous week. This amount is a combination of the US dollar’s contracts against the combined contracts of the euro (FXE), British pound (FXB), the Japanese yen (FXY), the Australian dollar (FXA), the Canadian dollar (FXC), and the Swiss franc.

Outlook for the US dollar

For the US dollar, politics are likely to remain in the driver’s seat this week. Another positive step towards tax reform could help the US dollar, but once the news sinks in, markets are likely to focus on news surrounding Russian involvement in US elections. The key economic data release for the week is the non-farm payrolls on Friday, and another positive reading could boost the US dollar against other major currencies.

In the next part of this series, we’ll discuss how bond market investors reacted to political developments in Washington.